89235MPL9

Toyota Financial Sgs Bk Conditional Puts - Death Of Holder - Restricted States: OH,TX, FDIC#57542

12/02/2024

4.900

if its not this one i think its gone

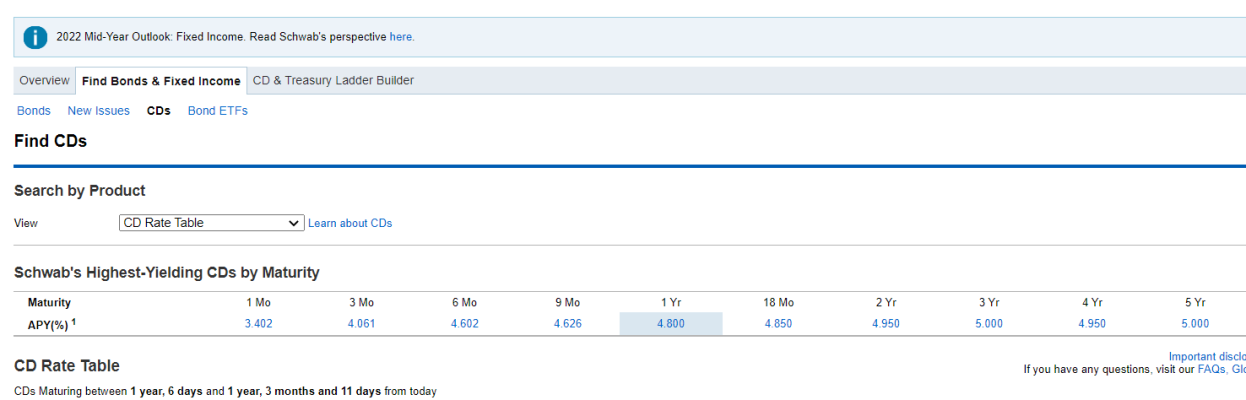

No, it was a different one. Four year, 5%. The CUSIP was 89235MPK1. It's gone already. I tried buying a Discover CD this morning and something similar happened. Grabbed a cup of tea and went to order them and they were gone already.