Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

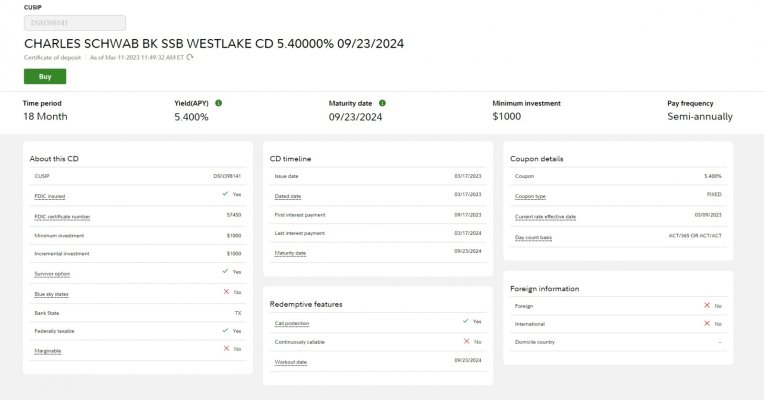

Not really. I've got a bunch from banks all over the country (large and small) many of which I have never heard of. I just try to be sure I stay under the 250k FDIC limit per bank since "sometimes" I buy multiple CD's from the same banks with different maturities.When you guys look for brokered CDs, do you care what banks they come from? I see Charles Schwab mentioned. Do you avoid smaller banks, like Pacific West Bankcorp, etc? Or, doesn't it matter due to fdic insurance?

But, I'll probably stay away from Silicon Valley banks for a while.

Last edited: