Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

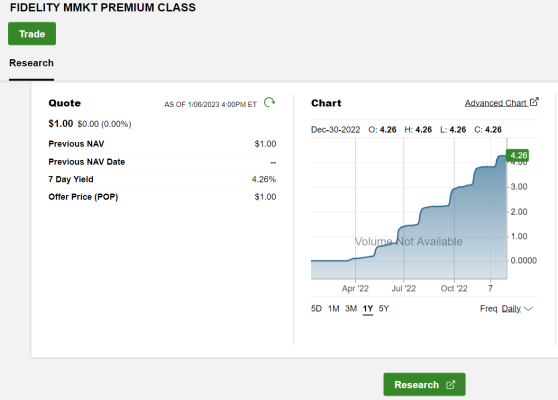

I think it's the 5 years that is pretty iffy. Short-term CDs at 5% are pretty likely this year. But, I think I'd rather keep my money available in my money market settlement account than buy very short-term CDs.

I just had a CD roll over. Even CDs with only a 2 year duration are starting to become callable. The yield on a callable 2 year CD is 0.1% more this morning. Not enough, IMO. I bought a non callable CD.

Last edited: