Major Tom

Thinks s/he gets paid by the post

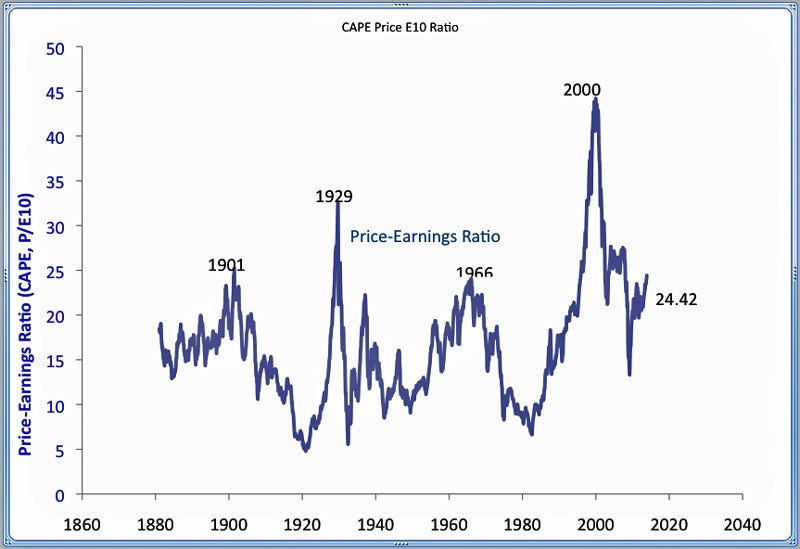

Forced to Retire - I will let others give their opinions and reasoning as to why it would not be a good idea to withdraw more than 4% from a 50/50 (or some other similar AA) portfolio and expect it to last 40 years.If anything the four percent figure is way too conservative.

If the next forty years is the same as the last forty years, someone who invested in a 50/50 total stock and bond fund portfolio and took out four percent of their money each year and updated that amount to match inflation, would have 21 times their orginal investment. (If they reinvested the dividends)

You can verify it on this website:

https://www.portfoliovisualizer.com/backtest-asset-class-allocation

I will say that you would be well served to do plenty of reading and research for yourself. The multiple threads in this forum have much relevant reading. It never hurts to sit yourself down with a good book, or in front of a computer, and read, read, read.