Freedom56

Thinks s/he gets paid by the post

As a reference, the Vanguard Total Bond Index Fund SEC yield is currently 3.37%.

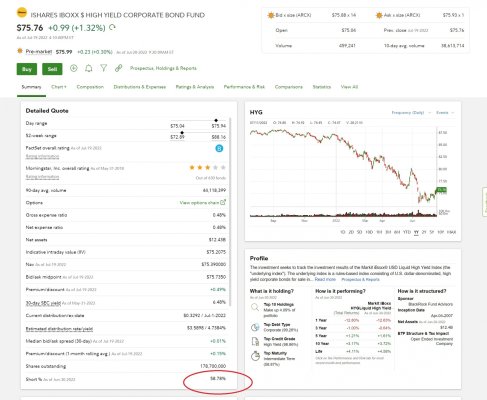

Once again, the SEC yield is a hypothetical calculation based on the assumption that all bonds/notes in the fund will be held to maturity. This just won't happen. They are holding a lot of low coupon debt while the price of that debt has fallen to compensate for the rise in yields, the coupon payments will not increase for the fund. You should look at distribution yields which these funds are going out of their way to hide but they show SEC yields prominently to lure unsuspecting investors. Distribution yields need to be at least 1 to 1.5 percentage points higher than the comparable treasury of the same duration to compensate for market risk. While the Fed raises rates, these funds will be in buy high/sell low mode. More specifically, they bought low coupon debt at or above par in 2021, now they are selling them well below par.