haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

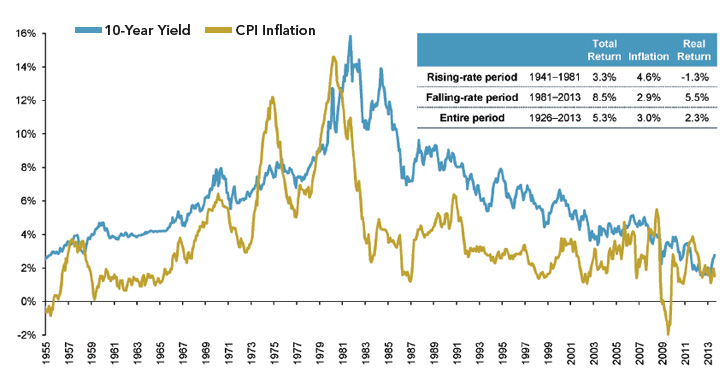

The threads have mostly gone off the front page, but there have been many posts lately which seem to suggest that "there is no way but down" for bond quotations, nowhere but up for interest rates. This is incompatible with an even reasonably efficient market, but this kind of argument rarely gets traction.

But the facts are that the low interest rate on the 10 year treasury happened almost a year ago, on 4/28/2013 at 1.66%. (Rates and dates are as close as I can see them on the chart). From there over a little over one month rates climbed to 2.74% on July 5. Since then there has been a fairly narrow trading range, with a high of 3.03% on December31 and settling at 2.80% today. To me, this market strongly trended from April 28, 2013 until July 5, 2013, and has backed and filled since.

http://www.bloomberg.com/quote/USGG10YR:IND

So I don't understand from whence comes the idea that the 10 year treasury rate must necessarily go up. It seems to me that based on fundamentals, politics and the chart, it could do anything or nothing much.

I can't beat the drum here for any investment, but I also think that it seems questionable that a stampede out of bonds into stocks would have much to recommend it.

Ha

But the facts are that the low interest rate on the 10 year treasury happened almost a year ago, on 4/28/2013 at 1.66%. (Rates and dates are as close as I can see them on the chart). From there over a little over one month rates climbed to 2.74% on July 5. Since then there has been a fairly narrow trading range, with a high of 3.03% on December31 and settling at 2.80% today. To me, this market strongly trended from April 28, 2013 until July 5, 2013, and has backed and filled since.

http://www.bloomberg.com/quote/USGG10YR:IND

So I don't understand from whence comes the idea that the 10 year treasury rate must necessarily go up. It seems to me that based on fundamentals, politics and the chart, it could do anything or nothing much.

I can't beat the drum here for any investment, but I also think that it seems questionable that a stampede out of bonds into stocks would have much to recommend it.

Ha

Last edited: