- Joined

- Nov 27, 2014

- Messages

- 9,206

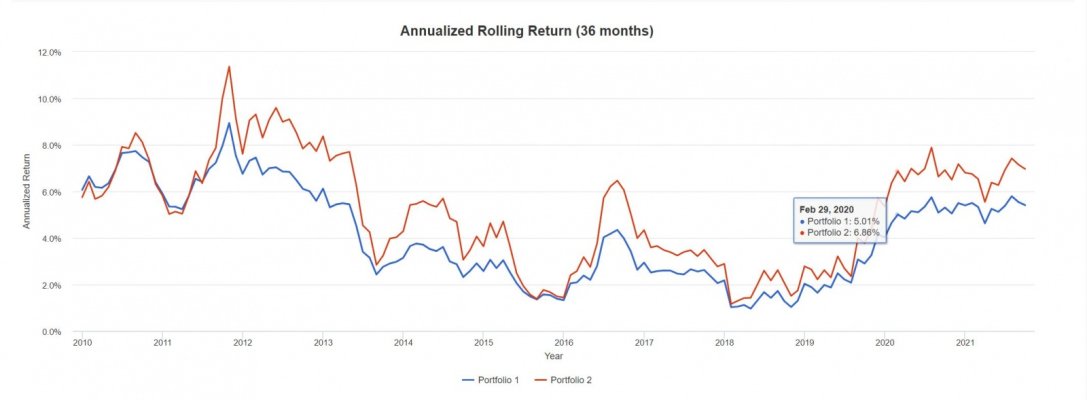

So I'm thinking of moving my IRA's to Fidelity and going with a two (maybe three) fund portfolio. In my initial research, the bond fund for Fidelity generally recommended is FXNAX. My concern is the duration of the bonds in that fund - over 6 years.

If you were starting a two fund portfolio today, what fund would you use for your bond allocation? I'm thinking I should get a bond fund with a very short duration - maybe even less than a year.

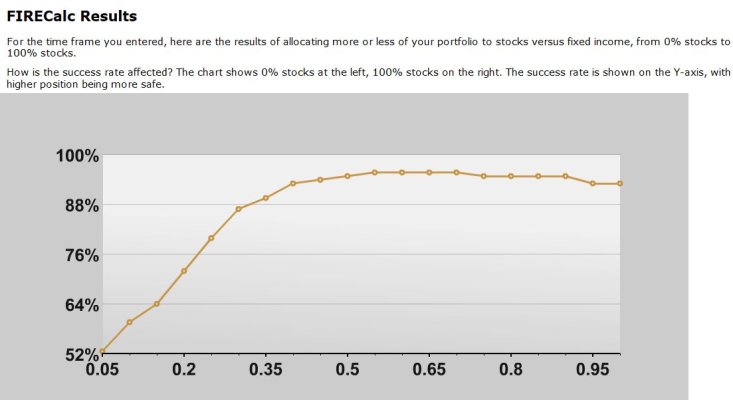

My allocation is very conservative and would likely be 70% bonds, so this question is very important to how I structure my IRA's going forward. I might go to 60% (40% stocks), but I'm more into keeping what I have than substantially growing my portfolio at this point in time.

Note - I have cash that will last one to two more years before I have to think about liquidating any of my other investments.

Thanks.

If you were starting a two fund portfolio today, what fund would you use for your bond allocation? I'm thinking I should get a bond fund with a very short duration - maybe even less than a year.

My allocation is very conservative and would likely be 70% bonds, so this question is very important to how I structure my IRA's going forward. I might go to 60% (40% stocks), but I'm more into keeping what I have than substantially growing my portfolio at this point in time.

Note - I have cash that will last one to two more years before I have to think about liquidating any of my other investments.

Thanks.