|

|

01-11-2018, 02:10 PM

01-11-2018, 02:10 PM

|

#21

|

|

Full time employment: Posting here.

Join Date: Apr 2010

Posts: 717

|

Quote: Quote:

Originally Posted by Cut-Throat

Think of it as "Old Age Insurance".... Yes, you get income at age 62, but by waiting until age 70, you'll get much more.... You are insuring that you'll have more money if you live a long time. No one knows the length of 'Total Life' as you say, so you buy a little insurance.

Basically it's the same reason that people Plan their withdrawal amounts and plan out to age 100, even though most people don't live that long. If someone told you that their financial plan ended at at age 80, you'd probably warn them, that they and their spouse may live a lot longer than that.....But for some reason when it comes to S.S. there are a lot of people that take the early amount and fail to insure that they may live a lot longer.... (The exception are people, who are so broke, that they cannot afford to delay the benefit)

|

That makes sense to me. You could calculate 'Total Life' as 100 for "stress" purposes, but still it's an simple math problem. That's why I started this thread 'Break-even SS 62 vs 66 vs 70 calculators ?' and confused when we start including into this all FIRE related decisions and calculators.

PS: Although I find this conversation very interesting and useful !

__________________

“The problem with the world is that the intelligent people are full of doubt, while the stupid people are full of confidence.”

(—Charles Bukowski)

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

01-11-2018, 02:21 PM

01-11-2018, 02:21 PM

|

#22

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2007

Location: Minneapolis

Posts: 1,172

|

Quote: Quote:

Originally Posted by wanaberetiree

That makes sense to me. You could calculate 'Total Life' as 100 for "stress" purposes, but still it's an simple math problem. That's why I started this thread 'Break-even SS 62 vs 66 vs 70 calculators ?' and confused when we start including into this all FIRE related decisions and calculators.

PS: Although I find this conversation very interesting and useful !  |

Here is another Calculation that you'll find useful....

Spend more money at age 62, by delaying S.S. to age 70.

|

|

|

01-11-2018, 02:22 PM

01-11-2018, 02:22 PM

|

#23

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2014

Location: Chicago West Burbs

Posts: 3,018

|

Quote: Quote:

Originally Posted by wanaberetiree

I guess I am missing something here

Why is SS like insurance? To me it's a source of income.

Say you have completed required amount of units and @62 you may get $1800, @67 - $2800 and @70 - $3100

Sure you will need to account for inflation (maybe yes or not) and life expectation. But why this math problem requires anything else?

If you define your goal as - max amount of $'s received over the total life.

Wrong? |

Considering a source of income, SS is less like the big payoff of a life insurance policy, more like disability insurance or unemployment insurance then.

That being said, some insurance policies have an income stream built in. I have an old whole life policy where I get to make the same tradeoffs as SS with the cash value, I get to choose when I collect, and how I collect it. Life with 10 yrs certain or 20 yrs certain, vs life, vs joint life (50% or 100%), vs 10 yr payout and the list goes on. So in that manner it can be compared to an insurance policy.

As for the "max amount", assuming you will be needing some money to cover your living expenses from 62-70 and beyond, you'll be balancing one's investment returns against SS. One does not know how long that life is. That makes it not so simple a an evaluation, certainly not with a high degree of accuracy.

|

|

|

01-11-2018, 04:03 PM

01-11-2018, 04:03 PM

|

#24

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2006

Posts: 4,629

|

Quote: Quote:

Originally Posted by Cut-Throat

I'm not seeing any 'Investment returns' - Just cost of living and Inflation for the SS Payouts.... Which I set to zero.

Bottom Line... If you understand how SS works, you should not even be calculating Break Even Age... It's like trying to Calculate your Break Even amounts on Fire Insurance, Medical Insurance....etc.

|

It asks for "discount rate". To me, that's equivalent to asking what you think your non-SS money will earn.

I agree with your second paragraph.

|

|

|

01-11-2018, 04:31 PM

01-11-2018, 04:31 PM

|

#25

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2006

Posts: 4,629

|

Quote: Quote:

Originally Posted by wanaberetiree

If you define your goal as - max amount of $'s received over the total life.

Wrong?

|

The dollars I need over my life depend on the number of years I live. If I live a lot of years, I'll spend a lot of dollars. If I live a few years, I'll spend just a few dollars.

The decision on when to start SS can be viewed as whether you want to use SS to provide a better match of lifetime dollars of income to lifetime dollars of spending.

I'm not sure if an analogy helps, but I'll try anyway. I know that insurance companies pay fewer dollars in claims than they collect in premiums. If I want to maximize my expected estate I should not buy insurance.

But, I still buy it. With insurance, the dollars I might possibly get if my house burns down are timed to match the extra dollars I need if that unlikely event occurs. Insurance improves my match between income and outgo.

The unexpected event that deferring SS may help with is the possible (though unlikely) case that I survive to an unusually old age. In that case I need extra money, and deferring SS may give me extra money just when I need it.

|

|

|

01-11-2018, 04:33 PM

01-11-2018, 04:33 PM

|

#26

|

|

Full time employment: Posting here.

Join Date: Apr 2010

Posts: 717

|

Quote: Quote:

Originally Posted by Independent

The unexpected event that deferring SS may help with is the possible (though unlikely) case that I survive to an unusually old age. In that case I need extra money, and deferring SS may give me extra money just when I need it.

|

This is a good point! Did not think about this 'edge case' in this light, thx!

__________________

“The problem with the world is that the intelligent people are full of doubt, while the stupid people are full of confidence.”

(—Charles Bukowski)

|

|

|

01-11-2018, 05:15 PM

01-11-2018, 05:15 PM

|

#27

|

|

Thinks s/he gets paid by the post

Join Date: Nov 2015

Posts: 2,692

|

Quote: Quote:

Originally Posted by Lawrencewendall

I used a simple spreadsheet that tallied the 3 columns to see where each colum matched or was greater than the other/s.

|

Definitely a simple approach but that ignores the earnings of keeping money invested (in safe funds) by drawing earlier.

|

|

|

01-11-2018, 09:42 PM

01-11-2018, 09:42 PM

|

#28

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,370

|

Analyze simply shows a projection of SS based on the information that you provide and then discounts the cash flows at the discount rate. Thier default is 2%, but like others, I think that is nonsense.... I override the 2% with 6%, which is my estimated long-term forward investment earnings rate.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

01-12-2018, 05:41 AM

01-12-2018, 05:41 AM

|

#29

|

|

Full time employment: Posting here.

Join Date: May 2015

Location: Atlanta suburbs

Posts: 633

|

Quote: Quote:

Originally Posted by HMMY

You can't solve for breakeven age because there is more than one variable. It depends on inflation, how much you invest, how your assets are invested, and how much they grow. Basically, if you think that you will be short-lived, take it early. If you need the money to survive, take it early. If you think you will have an average life span, take it at FRA. You get the full benefit of delaying to 70 if you live longer than the average bear. Regardless, if you can afford it, I would delay to 70 because I consider SS as longevity insurance and there is no annuity with a guaranteed 8% growth from 67 to 70 with annual COLA increases.

|

and don't forget to take into consideration that you have a spouse (if you have one).

|

|

|

05-09-2018, 06:50 AM

05-09-2018, 06:50 AM

|

#30

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

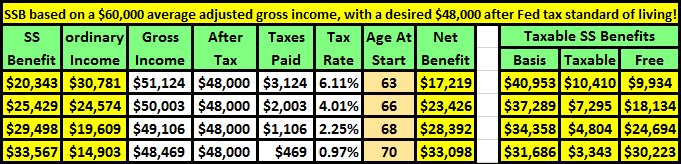

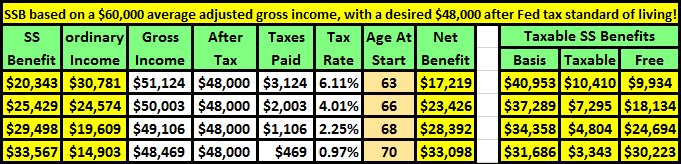

One of the largest variables that you should consider is where your other income will be coming from. The following example assumes that all of that other income is coming from taxable sources, pensions, 401K, IRA, annuities, etc.

The more you get from Social Security, the less you need from other sources, the longer your savings lasts. This results in giving less back to the IRS. Break Even for $20,343 vs $33,567 takes longer than $17,219 vs $33,098! What is your actual income from the Federal Government, "After Tax"? Your Social Security benefits are given to you "Tax Deferred", how much do you actually get "Tax Free"?

Another thing to consider is how much of your benefit do you get tax free and how much is taxable income.

|

|

|

05-09-2018, 07:09 AM

05-09-2018, 07:09 AM

|

#31

|

|

gone traveling

Join Date: Mar 2015

Posts: 3,508

|

Quote: Quote:

Originally Posted by Sandy & Shirley

One of the largest variables that you should consider is where your other income will be coming from. The following example assumes that all of that other income is coming from taxable sources, pensions, 401K, IRA, annuities, etc.

The more you get from Social Security, the less you need from other sources, the longer your savings lasts. This results in giving less back to the IRS. Break Even for $20,343 vs $33,567 takes longer than $17,219 vs $33,098! What is your actual income from the Federal Government, "After Tax"? Your Social Security benefits are given to you "Tax Deferred", how much do you actually get "Tax Free"?

Another thing to consider is how much of your benefit do you get tax free and how much is taxable income. |

Sorry. I looked at this several times and I don't see how it helps make a decision as to when to start SS benefits.

Can you explain?

|

|

|

05-09-2018, 08:18 AM

05-09-2018, 08:18 AM

|

#32

|

|

Full time employment: Posting here.

Join Date: Feb 2017

Location: Severn

Posts: 947

|

Since I originally posted, I discovered that PC will allow me to create several scenarios and compare them side by side. It showed me that it was better to draw early and not touch my portfolio as the portfolio was increasing more than the increase by postponing SS. When the chart got out to age 80 or so, drawing SS at 62, the portfolio was close to 1/4 mil larger than drawing at 70. Of course there is no guarantee of future portfolio earnings. It used my historical 8.8% earnings to project with 90k annual expenses.

|

|

|

05-09-2018, 08:28 AM

05-09-2018, 08:28 AM

|

#33

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2003

Location: Florida's First Coast

Posts: 7,723

|

You can do this yourself quite easily. Here is an example, let us assume for this one that one's life expectancy is 82. You can use any age you like, but for me I will be So lucky to get anywhere near it.

SS @ 62 = $1638 Per Month ($393,120 received by 82)

SS @ 65 = $2160 Per Month ($440,640 received by 82)

SS @ 66 = $2300 (FRA) ($441,600 received by 82)

SS @ 70 = $3050 ($439200 received by 82)

So in IMHO for my case the best age to take SS would be 65.

__________________

"Never Argue With a Fool, Onlookers May Not Be Able To Tell the Difference." - Mark Twain

|

|

|

05-09-2018, 08:28 AM

05-09-2018, 08:28 AM

|

#34

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

This chart does not “make a decision” on when to start your benefits, it merely gives you more information from another perspective.

If you compare the full benefits for age 63 vs age 66, break even does not happen until age 77. The gross $20,343 for 15 years is $305,150 which is identical to the gross $25,429 for 12 years.

When you consider the net benefits, how much did you get from the Federal Government after tax, break even happens more than 3 years earlier, prior to age 74. The net $17,219 for 12 years is $206,628 which is less than the net $23,426 for 9 years at $210,837.

Many individuals make this decision based on the break even calculations based only on using their gross benefits amounts, but there are other factors to consider. If you are getting $20,343 and they are taking back $3,124, do you want to make decisions only on what you got, or do you want to make that decision on what you have left after they take some of it back.

Again, this chart does not in any way make a decision for you, it only gives you more information.

The right side of the chart is another interesting piece of information. If you do the math, 49% of your age 63 benefit is tax free income while 90% of your age 70 benefit is tax free!

Again, just more information so you can make a more informed decision.

|

|

|

05-09-2018, 08:37 AM

05-09-2018, 08:37 AM

|

#35

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

Quote: Quote:

Originally Posted by ShokWaveRider

You can do this yourself quite easily. Here is an example, let us assume for this one that one's life expectancy is 82. You can use any age you like, but for me I will be So lucky to get anywhere near it.

SS @ 62 = $1638 Per Month ($393,120 received by 82)

SS @ 65 = $2160 Per Month ($440,640 received by 82)

SS @ 66 = $2300 (FRA) ($441,600 received by 82)

SS @ 70 = $3050 ($439200 received by 82)

So in IMHO for my case the best age to take SS would be 65.

|

Again, are you looking at the gross amount they are giving you, or the net amount after they take some of it back as taxes? Look at the Tax Rate, Taxable, and Free columns. Larger benefits result in less taxable income and more tax free income which reduces your overall tax rate from 6.11% to 4.01% to 2.25% to 0.97%.

| When to start | Gross | net age | Net | by age 82 | | SS @ 62 = $1638 Per Month | $393,120 | 63 | $334,380 | received by 82) | | SS @ 65 = $2160 Per Month | $440,640 | 66 | $398,247 | received by 82) | | SS @ 66 = $2300 (FRA) | $441,600 | 68 | $425,876 | received by 82) | | SS @ 70 = $3050 | $439200 | 70 | $430,273 | received by 82) |

|

|

|

05-09-2018, 08:43 AM

05-09-2018, 08:43 AM

|

#36

|

|

gone traveling

Join Date: Apr 2011

Posts: 3,375

|

Quote: Quote:

Originally Posted by wanaberetiree

Any suggestions to a simple but reliable calculator to compare Social Security benefits. e.g. 62 vs 66 vs 70 ?

Thx

|

Depends on if you have a spouse & whether they will/could collect spousal benefits.

|

|

|

05-09-2018, 09:12 AM

05-09-2018, 09:12 AM

|

#37

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2018

Location: Tampa

Posts: 11,298

|

Quote: Quote:

Originally Posted by Sandy & Shirley

Again, are you looking at the gross amount they are giving you, or the net amount after they take some of it back as taxes? Look at the Tax Rate, Taxable, and Free columns. Larger benefits result in less taxable income and more tax free income which reduces your overall tax rate from 6.11% to 4.01% to 2.25% to 0.97%.

| When to start | Gross | net age | Net | by age 82 | | SS @ 62 = $1638 Per Month | $393,120 | 63 | $334,380 | received by 82) | | SS @ 65 = $2160 Per Month | $440,640 | 66 | $398,247 | received by 82) | | SS @ 66 = $2300 (FRA) | $441,600 | 68 | $425,876 | received by 82) | | SS @ 70 = $3050 | $439200 | 70 | $430,273 | received by 82) |

|

Question for you S&S:

Since I am in a loving NON married relationship, would this concept of effectively waiting to 70 y.o. result in an even better net tax situation since the hurdle of 25k for each single is better than the 32k married hurdle?

__________________

TGIM

|

|

|

05-09-2018, 09:22 AM

05-09-2018, 09:22 AM

|

#38

|

|

gone traveling

Join Date: Dec 2015

Location: Berkeley, Denver, CO, USA

Posts: 1,406

|

I spent money for a 2-year subscription to https://maximizemysocialsecurity.com

I think the $80 was worth it.

You can easily use real data and play many scenari.

|

|

|

05-09-2018, 09:37 AM

05-09-2018, 09:37 AM

|

#39

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2018

Location: Tampa

Posts: 11,298

|

Quote: Quote:

Originally Posted by davebarnes

|

I know the author developed ES Planner. I wonder if there is any comprehensive SS functionality in that tool?

__________________

TGIM

|

|

|

05-09-2018, 09:51 AM

05-09-2018, 09:51 AM

|

#40

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Aug 2011

Location: West of the Mississippi

Posts: 17,263

|

Quote: Quote:

Originally Posted by Independent

T

The unexpected event that deferring SS may help with is the possible (though unlikely) case that I survive to an unusually old age. In that case I need extra money, and deferring SS may give me extra money just when I need it.

|

Agreed.

And there is one other for some of us. The need to pay for long term care later in life. I have just finished looking at LTC insurance and for me the costs/benefit ratio does not make a lot of sense.

By delaying SS to 70 I get a chunk of extra cash that can help pay LTC costs (not completely, that I know) if I need it. I can combine the 'extra' SS money with the premium money and go pretty far towards paying LTC.

OTOH, If I don't need LTC, I can spend the money on wine, women and song pizza and beer for me and my buddies.

__________________

Comparison is the thief of joy

The worst decisions are usually made in times of anger and impatience.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|