Many anti-Fed and some moderate economists point out on bubbles almost in every asset class. However what if the Fed despite prolonged talking of interest rates increase actually are going to continue the bubbles inflation with "easy money" policy for much longer(QE, negative rates, helicopter money etc)? Surely it will keep bubbles from bursting, create much higher inflation, help dealing with huge Debt.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bubbles all over the place

- Thread starter haha

- Start date

When a bubble's risk gets too high the standard approach is to hedge. For example, if you deem Treasuries too pricey you can short them via something like TBT. It's another way to diversify. One assets class that IMO is less bubbly is real estate.

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Here's the $64k question. If this is bubble territory for stocks(and I believe it is), what is the re-entry point for indexer's?

W2R

Moderator Emeritus

Ha, I think you need a supporting "whee" from W2R to back up your sell call.

I'm pretty happy with the market lately, I must admit..

Edited to add: I just checked, and my portfolio (including bank accounts) is now nearly 95% of its highest value ever, on 4/24/2015 shortly before I sold a chunk of it and bought my dream home in cash. If it rises to equal that pre-dream-home amount or more, then did I get my dream home for free?

Last edited:

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm pretty happy with the market lately, I must admit..

Edited to add: I just checked, and my portfolio (including bank accounts) is now nearly 95% of its highest value ever, on 4/24/2015 shortly before I sold a chunk of it and bought my dream home in cash. If it rises to equal that pre-dream-home amount or more, then did I get my dream home for free?Just kidding but it's an intriguing idea. I LOVE THIS BUBBLE!!! It's so much fun.

Ha just got his confirmation.

I just checked, and my portfolio (including bank accounts) is now nearly 95% of its highest value ever, on 4/24/2015 shortly before I sold a chunk of it and bought my dream home in cash. If it rises to equal that pre-dream-home amount or more, then did I get my dream home for free?Just kidding but it's an intriguing idea.

At last, someone thinks like me! But then I've always been a practitioner of rubber math.

W2R

Moderator Emeritus

Luckily there are a lot of engineers and various math geeks here, so I feel comfortable cracking math jokes once in a while.At last, someone thinks like me! But then I've always been a practitioner of rubber math.

Luckily there are a lot of engineers and various math geeks here, so I feel comfortable cracking math jokes once in a while.But there are one or two people here who honestly don't understand them and get all upset so I should probably just stop it and only speak of math in deadly serious contexts.

I don't know. I sort of feel that math - like humor - is too important to be taken seriously.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Another imploding bubble is over in tech & VC land. Fortunately only rich insiders and founder hopefuls suffer from those. Many unicorns are losing their horns right now, and turn out to be limp horses instead.

In some ways I hope the tech bubble does pop before too long. It is making housing prices and rents in our area kind of crazy and leading to more and more homeless at the lower end of the economic spectrum. Today I was stopped at a light and there was a homeless person with a shopping cart to my left and a young engineer type in a new looking Porsche on my right.

Here's the $64k question. If this is bubble territory for stocks(and I believe it is), what is the re-entry point for indexer's?

I can see the SP at ~ 800 if the Fed had not screw up with the rates.

If negative rates are coming, the bubble will get more bubbly.

I wonder how many consumers are willing to pay the banks for their deposit.

Proteus126

Recycles dryer sheets

- Joined

- Apr 20, 2015

- Messages

- 52

Low rates support high P/E multiples on stocks. 2% S&P 500 dividends plus the probability of short to intermediate term asset growth make it the only game in town. Low rates look like they will continue for quite some time.

The S&P 500 has weathered several (4 ?) moderate downturns in the past 24 months, motivated by a variety of fears (valuation, oil, Europe) and has a solid floor built in. Exuberance is low but fear has abated a bit. Sounds like a setup for lower volatility and steady upward price creep in the short term.

Given the globally entrenched low rate environment, I feel that the S&P is correctly priced for this low-rate regime or just a tad high but nowhere near the bubble-popping stage based just on index price. In fact I think it is poised to move 10% higher in the next 6 months.

One of these years, rates will be higher. At that time, multiples will have contracted significantly and we will all feel poorer in our stock accounts. Play it like we always play it, by picking the asset allocation you like based on risk tolerance and needs and rebalancing every 3 to 6 months, pocketing the stock gains along the way. Keep in mind a moderately ugly scenario (30%-40% correction lasting 1-2 years, say) and make sure that your plans and asset allocation are tuned such that you can live with it. The higher it goes from here forward the larger the eventual correction.

I honestly could see the S&P 500 at 1500 or 2500 in the next 12 months. I feel that 1500 is less likely. I just have no clue and won't bother trying to time it, other than using dips to shovel a little cash into the Roth if I manage to catch it.

The S&P 500 has weathered several (4 ?) moderate downturns in the past 24 months, motivated by a variety of fears (valuation, oil, Europe) and has a solid floor built in. Exuberance is low but fear has abated a bit. Sounds like a setup for lower volatility and steady upward price creep in the short term.

Given the globally entrenched low rate environment, I feel that the S&P is correctly priced for this low-rate regime or just a tad high but nowhere near the bubble-popping stage based just on index price. In fact I think it is poised to move 10% higher in the next 6 months.

One of these years, rates will be higher. At that time, multiples will have contracted significantly and we will all feel poorer in our stock accounts. Play it like we always play it, by picking the asset allocation you like based on risk tolerance and needs and rebalancing every 3 to 6 months, pocketing the stock gains along the way. Keep in mind a moderately ugly scenario (30%-40% correction lasting 1-2 years, say) and make sure that your plans and asset allocation are tuned such that you can live with it. The higher it goes from here forward the larger the eventual correction.

I honestly could see the S&P 500 at 1500 or 2500 in the next 12 months. I feel that 1500 is less likely. I just have no clue and won't bother trying to time it, other than using dips to shovel a little cash into the Roth if I manage to catch it.

eytonxav

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't know. I sort of feel that math - like humor - is too important to be taken seriously.

Especially statistics

The 2000 bubble was weird because although average equity index valuations were extremely high, there was great divergence between sectors. Anything .com or tech was at insane levels, everything "real economy" was bargain basement. Do we have something like that now? Well, utilities and the like with steady dividends are probably at crazy levels. You cannot give cyclicals away, OTOH. So I would say that the divergence is not quite as spectacular as it was in 2000, but it definitely is there.

Yeah, I bought my first Berkshire class B share during that bubble, and it was priced at an extremely attractive valuation. Likewise with a bunch of "old economy" stuff like Allstate, REITs, Target, etc. It was a crazy market, but there were plenty of cheap stocks available.

These days, nothing I follow appears to be cheap.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have not seen a solid quantitative argument for a bubble in the SP500, the general equity markets. Maybe in narrow segments which I do invest in.

Still at 60/40. My last rebalance was to vfsux, short term investment grade.

Still at 60/40. My last rebalance was to vfsux, short term investment grade.

CaliforniaMan

Full time employment: Posting here.

+1Low rates support high P/E multiples on stocks. 2% S&P 500 dividends plus the probability of short to intermediate term asset growth make it the only game in town. Low rates look like they will continue for quite some time.

The S&P 500 has weathered several (4 ?) moderate downturns in the past 24 months, motivated by a variety of fears (valuation, oil, Europe) and has a solid floor built in. Exuberance is low but fear has abated a bit. Sounds like a setup for lower volatility and steady upward price creep in the short term.

Given the globally entrenched low rate environment, I feel that the S&P is correctly priced for this low-rate regime or just a tad high but nowhere near the bubble-popping stage based just on index price. In fact I think it is poised to move 10% higher in the next 6 months.

One of these years, rates will be higher. At that time, multiples will have contracted significantly and we will all feel poorer in our stock accounts. Play it like we always play it, by picking the asset allocation you like based on risk tolerance and needs and rebalancing every 3 to 6 months, pocketing the stock gains along the way. Keep in mind a moderately ugly scenario (30%-40% correction lasting 1-2 years, say) and make sure that your plans and asset allocation are tuned such that you can live with it. The higher it goes from here forward the larger the eventual correction.

I honestly could see the S&P 500 at 1500 or 2500 in the next 12 months. I feel that 1500 is less likely. I just have no clue and won't bother trying to time it, other than using dips to shovel a little cash into the Roth if I manage to catch it.

I agree, and very nicely put.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

The market is fully valued now, with the high P/E maybe justified by the low interest rate and inflation.

The chance of it going up a bit is about the same as for it going down a little.

However, the chance of it going down a lot is higher than for it to go up a lot. What wonderful things can happen for stocks to go up a lot? Interest rate to go even lower, to negative? Corporate earnings to go through the roof? In contrast, all kinds of bad things can happen for it to go down a lot (and you do not even need an asteroid strike).

So, my perception of the risk level causes me to cut back my stock AA to 50%, while I traditionally ran 70% to 80%.

And I will continue to enhance my yield by writing covered calls on the stocks that I hold, and alternating that with writing cash-secured puts on my cash, as I see fit.

The chance of it going up a bit is about the same as for it going down a little.

However, the chance of it going down a lot is higher than for it to go up a lot. What wonderful things can happen for stocks to go up a lot? Interest rate to go even lower, to negative? Corporate earnings to go through the roof? In contrast, all kinds of bad things can happen for it to go down a lot (and you do not even need an asteroid strike).

So, my perception of the risk level causes me to cut back my stock AA to 50%, while I traditionally ran 70% to 80%.

And I will continue to enhance my yield by writing covered calls on the stocks that I hold, and alternating that with writing cash-secured puts on my cash, as I see fit.

Last edited:

The market is fully valued now, with the high P/E maybe justified by the low interest rate and inflation.

The chance of it going up a bit is about the same as for it going down a little.

However, the chance of it going down a lot is higher than for it to go up a lot. What wonderful things can happen for stocks to go up a lot? Interest rate to go even lower, to negative? Corporate earnings to go through the roof? In contrast, all kinds of bad things can happen for it to go down a lot (and you do not even need an asteroid strike).

So, my perception of the risk level causes me to cut back my stock AA to 50%, while I traditionally ran 70% to 80%.

And I will continue to enhance my yield by writing covered calls on the stocks that I hold, and alternating that with writing cash-secured puts on my cash, as I see fit.

Seems logical to me. No noise is not always good. Noise is usually not good.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

OK, I tend to agree with some of your thoughts. But when I've done some studies of methods to cut back when markets were in such states, I've not come up with a good way to avoid missing gains. I think it is only in the extremes where it is a good idea to dial back. Are we there yet?...

So, my perception of the risk level causes me to cut back my stock AA to 50%, while I traditionally ran 70% to 80%.

...

Here is a table I update yearly around August. It is from Vanguard's site for various of the style asset classes:

It shows that most of these asset classes are about 10% to 40% above their 2011 values. I don't have year 2000 data but I would bet that was really extreme for large growth (LG in the table). To me these asset classes are not extreme enough out of bounds to make a move. I personally hold the value tilted portions ... vtv, voe, vbr.

Markola

Thinks s/he gets paid by the post

So, my perception of the risk level causes me to cut back my stock AA to 50%, while I traditionally ran 70% to 80%.

Good luck and I'm sure you're not alone. I thought about getting more conservative, too, but I'm still a working stiff and have decided to leave my 80/20 AA alone and keep piling up shares, come what may. Fiddling around has cost me more money in the past than ignoring the portfolio and buying more of it. There's a chance things won't go up or down anytime soon but just sideways for a long while.

Sent from my iPad using Early Retirement Forum

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

... Here is a table I update yearly around August. It is from Vanguard's site for various of the style asset classes:

It shows that most of these asset classes are about 10% to 40% above their 2011 values. I don't have year 2000 data but I would bet that was really extreme for large growth (LG in the table)...

I just found out that it is difficult to get historical P/E for various market segments. Surely, somebody has it, but does not want to share.

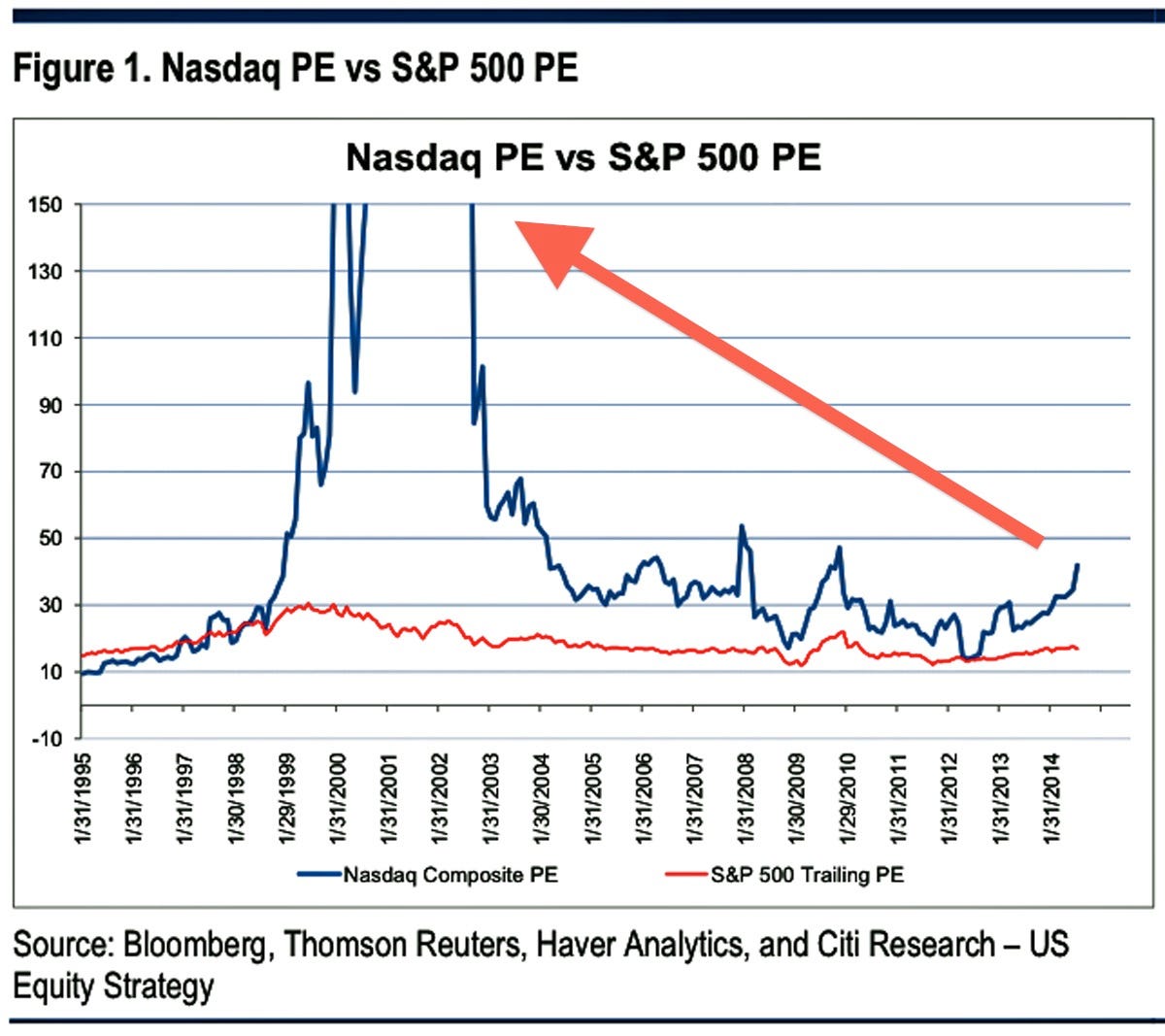

The only thing I have found is the following chart showing that in 2000 the Nasdaq P/E went through the roof, while that of the S&P reached 30.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

... There's a chance things won't go up or down anytime soon but just sideways for a long while...

Hence, my hedge by doing options on the side to get a bit more spending money, while maintaining 50% stock AA. If the market just bounces around, I can pick up another 1% a year with my conservative option play, and maybe even 2% if I get more aggressive.

I have no more fresh money to buy stocks if the market crashes, so need to be more conservative than when I was still working.

Last edited:

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

From Shiller data the SP500 PE max'd at 35.3 in July 1999....Nasdaq P/E went through the roof, while that of the S&P reached 30.

I remember Abbey Cohen saying that valuations weren't a particularly good timing mechanism. That was sometime in 2000 I think. Perhaps a bit of right and wrong in that statement.

At any rate, we are nowhere near such extremes and were not in 2008. In 2008 the stock market suffered from collateral damage of the real estate bubble. So yes, could be something that happens in our other markets (like bonds?) or even in China. Could also be a few years off ... who knows.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Nothing is a perfect mechanism for timing. It's all a matter of probability. When the P/E is high, it's more likely to revert than to keep going higher. The latter is certainly possible, else I would be 0% in stock instead of 50%.

Similar threads

- Replies

- 38

- Views

- 2K

- Replies

- 22

- Views

- 892

- Replies

- 44

- Views

- 5K