Surewhitey

Thinks s/he gets paid by the post

Spent a little time trying to make my explanation for DW on our situation. I'd love some input on your ideas and hole poking.

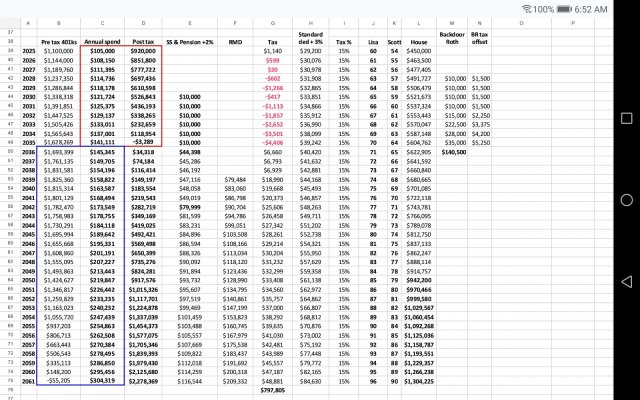

Very high view of spending & accounts to pull from here. Red pill is the post tax drawdown and possible ACA benefits. Our spending is ~$70k, so a $105k would give us some wiggle room for lumpy stuff.

The blue pill is pre tax accounts with RMDs & a 15% tax on everything (gotta start somewhere).

SS & Pension will be fluff going back into the post tax & grow for future needs. All growth is a modest 4% assumption.

I'd love some feedback from the spreadsheet nerds out there. Anything I can do to simplify?

Very high view of spending & accounts to pull from here. Red pill is the post tax drawdown and possible ACA benefits. Our spending is ~$70k, so a $105k would give us some wiggle room for lumpy stuff.

The blue pill is pre tax accounts with RMDs & a 15% tax on everything (gotta start somewhere).

SS & Pension will be fluff going back into the post tax & grow for future needs. All growth is a modest 4% assumption.

I'd love some feedback from the spreadsheet nerds out there. Anything I can do to simplify?

Attachments

Last edited: