corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

Last day of work was 4 days ago and I am already struggling with spending in retirement. My plan was always pretty simple: 100% Probability of Success (Ps) with $25k / year of discretionary spending. We far exceeded that and we now have $400k more than we need for 100% Ps. Ok, great. Let's just keep that as an insurance policy for unknown unknowns. Let's get through year 1 hunkered down and prepared for battle.

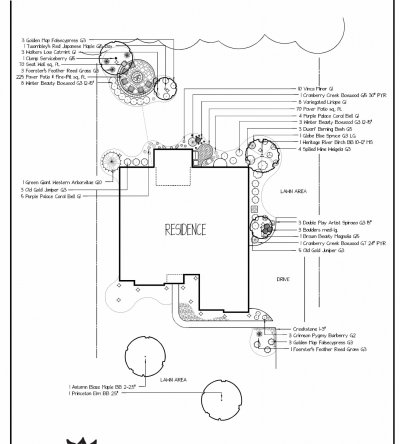

Well, DW is getting estimates for putting in landscaping, including a kick butt fire pit area. Estimates are coming in @ $35k. We'll see what the final tally is because she is getting all the bells and whistles in the estimates.

My difficulty comes in deciding whether we can afford it. And I cannot for the life of me come up with an answer. We have exceeded our goal of 100% Ps. Current VPW calculation puts us @ $50k year for discretionary spending. We are ok with sticking to $25k / year, but BAM!, here we are on day 4 looking at spending $35k on landscaping.

Please help!

Well, DW is getting estimates for putting in landscaping, including a kick butt fire pit area. Estimates are coming in @ $35k. We'll see what the final tally is because she is getting all the bells and whistles in the estimates.

My difficulty comes in deciding whether we can afford it. And I cannot for the life of me come up with an answer. We have exceeded our goal of 100% Ps. Current VPW calculation puts us @ $50k year for discretionary spending. We are ok with sticking to $25k / year, but BAM!, here we are on day 4 looking at spending $35k on landscaping.

Please help!