I'll put it this way

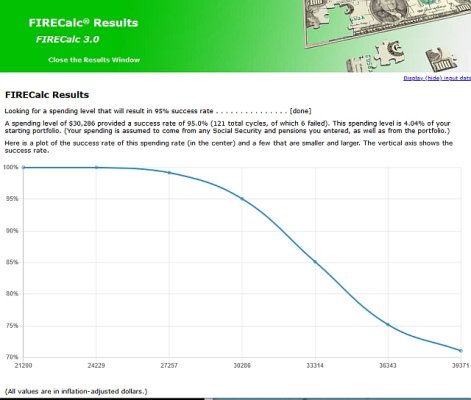

. I strove for a 100% success rate in FireCALC with annual expenses retirement expense starting at a minimum of $125-$130K (including taxes) to 100 years old (HA!) projection, and was able to achieve above that, in my situation (which may not be fully applicable to yours, which is why the recommendations to use the tools for you own), with 3 sources of income: pension, savings/investments, and (future, not taken yet) SS.

When I reached that goal, I was comfortable to retire, though I did have a "glide path" for a couple of years after that, you can peruse it here at

https://www.early-retirement.org/forums/f28/omy-glide-path-plans-81406.html). You can also, if interested, read my 3 year post-retirement summary at

https://www.early-retirement.org/fo...f-retirement-after-the-glide-path-109967.html

As I mentioned above, continue to do what you are doing - I am a better saver than an investor, so I always believe saving is primary - keep it simple, use the tools to ensure you are staying on track, and you will be fine

.