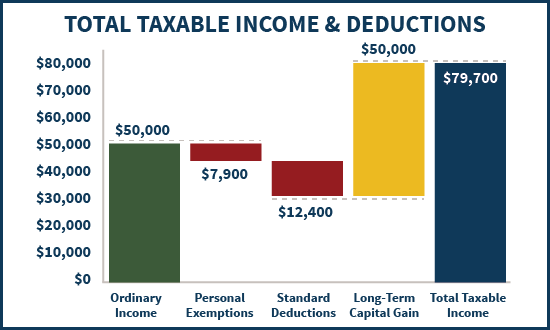

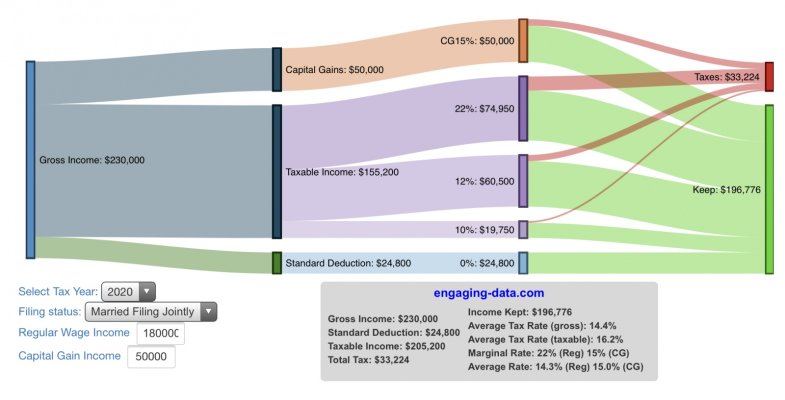

I understand that LTCGs are subject to more favorable tax rates than ordinary income, and that realizing long-term capital gains does not cause ordinary income to be taxed at a higher rate. But looking at Form 1040 it appears that LTCG are included in total income, AGI, and taxable income after deductions.

Schedule D instructs to add short- and long-term gains (or losses) and to enter that amount on line 7 capital gains, which is then included in total income. Total income is then adjusted, but AGI appears to include the capital gains. Likewise, when deductions are made, they are made to AGI and the capital gains appear to carry through all the way to line 15 taxable income.

When I look at the tax tables, I see no distinction made for LTCG vs ordinary income. Ordinary income taxes key off line 15, taxable income.

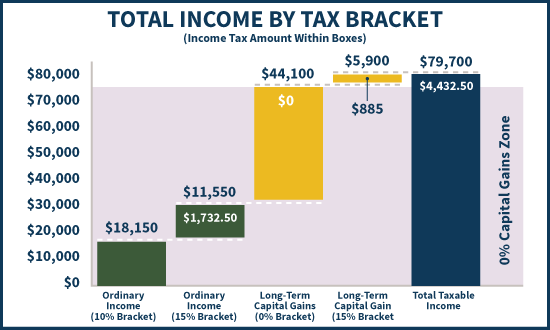

So, if taxable income includes capital gains, and those gains push my taxable income into a higher tax bracket, and taxes owed are figured on those brackets, where's provision that then separates out the LTCG from taxable income?

Another way of asking this is where on Form 1040 is the place where LTCGs are separated from ordinary income for tax purposes?

Schedule D instructs to add short- and long-term gains (or losses) and to enter that amount on line 7 capital gains, which is then included in total income. Total income is then adjusted, but AGI appears to include the capital gains. Likewise, when deductions are made, they are made to AGI and the capital gains appear to carry through all the way to line 15 taxable income.

When I look at the tax tables, I see no distinction made for LTCG vs ordinary income. Ordinary income taxes key off line 15, taxable income.

So, if taxable income includes capital gains, and those gains push my taxable income into a higher tax bracket, and taxes owed are figured on those brackets, where's provision that then separates out the LTCG from taxable income?

Another way of asking this is where on Form 1040 is the place where LTCGs are separated from ordinary income for tax purposes?