You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cramer's YTD Return

- Thread starter windsurf

- Start date

retire@40

Thinks s/he gets paid by the post

- Joined

- Feb 16, 2004

- Messages

- 2,670

Re: Cramer's YTD Retrun

That's pretty good considering the total market return was 1.80% through 10/31/05.

My investment return through 10/31 was 4.34%.

windsurf said:Jim Cramer's subscription portfolio has a 3.44% YTD return. FYI.

That's pretty good considering the total market return was 1.80% through 10/31/05.

My investment return through 10/31 was 4.34%.

Spanky

Thinks s/he gets paid by the post

Re: Cramer's YTD Retrun

My return was 8.31% until my company stock tumbled. YTD is now 4.8% -- not bad. Lesson learned -- could have sold the company stocks but postponed the sale because of reluctance to pay capital gain tax.

My return was 8.31% until my company stock tumbled. YTD is now 4.8% -- not bad. Lesson learned -- could have sold the company stocks but postponed the sale because of reluctance to pay capital gain tax.

dex

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 28, 2003

- Messages

- 5,105

Re: Cramer's YTD Retrun

Makes 4 week treasury bills look good.

Makes 4 week treasury bills look good.

thefed

Thinks s/he gets paid by the post

- Joined

- Oct 29, 2005

- Messages

- 2,203

Re: Cramer's YTD Retrun

My YTD is 12.62%. That's after John Hancock's ridicuously high expense ratios too...

My YTD is 12.62%. That's after John Hancock's ridicuously high expense ratios too...

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Re: Cramer's YTD Retrun

After taxes and transaction costs . . . (10%)

windsurf said:Jim Cramer's subscription portfolio has a 3.44% YTD return. FYI.

After taxes and transaction costs . . . (10%)

AltaRed

Full time employment: Posting here.

Re: Cramer's YTD Retrun

If you are in the energy or commodities industries, or similar cyclical industries, you have to take some profits off the table when the good times roll. I sold a good chunk of my employer's stock this year (oil company) and would like to do more if energy stocks take another run in early 2006. In my view, they have nowhere to go but down later in 2006.

Spanky said:My return was 8.31% until my company stock tumbled. YTD is now 4.8% -- not bad. Lesson learned -- could have sold the company stocks but postponed the sale because of reluctance to pay capital gain tax.

If you are in the energy or commodities industries, or similar cyclical industries, you have to take some profits off the table when the good times roll. I sold a good chunk of my employer's stock this year (oil company) and would like to do more if energy stocks take another run in early 2006. In my view, they have nowhere to go but down later in 2006.

Re: Cramer's YTD Retrun

5.2% before taxes, although there's gonna be a big slug of that this year after Tweedy's runup.

So most of us are outperforming Cramer despite his data networks, his 18-hour days, his driver, and his fawning Business Week profile? Hmmm....

5.2% before taxes, although there's gonna be a big slug of that this year after Tweedy's runup.

So most of us are outperforming Cramer despite his data networks, his 18-hour days, his driver, and his fawning Business Week profile? Hmmm....

Sheryl

Thinks s/he gets paid by the post

- Joined

- Apr 6, 2004

- Messages

- 1,463

Re: Cramer's YTD Retrun

Just the thought of trying to collect all this information and calculate the weighted average after disallowing the amounts that were new contributions.... makes me want to go back to bed.

But I know it was way more than 4%.

Just the thought of trying to collect all this information and calculate the weighted average after disallowing the amounts that were new contributions.... makes me want to go back to bed.

But I know it was way more than 4%.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Re: Cramer's YTD Retrun

He-he, he-he-he! My 4.8% YTD return dusts Cramer's notwithstanding the fact that I've had about 30% of the portfolio sitting in tax-exempt money market funds for most of the year.

He-he, he-he-he! My 4.8% YTD return dusts Cramer's notwithstanding the fact that I've had about 30% of the portfolio sitting in tax-exempt money market funds for most of the year.

tryan

Thinks s/he gets paid by the post

- Joined

- Mar 25, 2005

- Messages

- 2,604

Re: Cramer's YTD Retrun

needless to say my real estate kicked Cramer's butt (+15%). Looks like he might have been better-off in REITs.

needless to say my real estate kicked Cramer's butt (+15%). Looks like he might have been better-off in REITs.

C

Cut-Throat

Guest

Re: Cramer's YTD Retrun

4.66% so far this year. Just an Index investor here.

4.66% so far this year. Just an Index investor here.

unclemick

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Re: Cramer's YTD Retrun

Hmmm

I have no idea - not sure I really care - just hold my balanced index and will settle with the IRS on divs/interest in taxible portion when the time comes.

De Gaul and and the Norwegian widow and all that rot.

Heh heh heh

Hmmm

I have no idea - not sure I really care - just hold my balanced index and will settle with the IRS on divs/interest in taxible portion when the time comes.

De Gaul and and the Norwegian widow and all that rot.

Heh heh heh

HFWR

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Re: Cramer's YTD Retrun

6.9%

Boo-rah, indeed...

6.9%

Boo-rah, indeed...

Tadpole

Thinks s/he gets paid by the post

- Joined

- Jul 9, 2004

- Messages

- 1,434

Re: Cramer's YTD Retrun

9.7%. And I don't even know what I am doing. (I will qualify this by saying I have done quite badly the last two months.)

9.7%. And I don't even know what I am doing. (I will qualify this by saying I have done quite badly the last two months.)

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Re: Cramer's YTD Retrun

Is there anyone who did worse than Cramer??

Maybe we should all make our fortune selling investment advice to gullible lemmings the masses.

Is there anyone who did worse than Cramer??

Maybe we should all make our fortune selling investment advice to gullible lemmings the masses.

Re: Cramer's YTD Retrun

I may have not done worse, but same ballpark! For all the talk on this board about 4 pillars and "being the market, not beating it" we have a lot of people beating the market's socks off! Are all of you high flyers energy investors, REITs or what?

. . . Yrs to Go said:Is there anyone who did worse than Cramer??

Maybe we should all make our fortune selling investment advice to gullible lemmings the masses.

I may have not done worse, but same ballpark! For all the talk on this board about 4 pillars and "being the market, not beating it" we have a lot of people beating the market's socks off! Are all of you high flyers energy investors, REITs or what?

HFWR

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

C

Cut-Throat

Guest

Re: Cramer's YTD Retrun

This may be what I call the 'Las Vegas' syndrome. Have you ever talked to anyone that actually lost in Vegas? They all win! - I often wonder how those Casino's stay in business.

The big gainers here are obviously taking more risk. There may be some that did a lot worse, but they may not admit to it, as this beating the market is an ego thing as well. I admit I do not have any special skills to beat the market. Hence I index.

Laurence said:I may have not done worse, but same ballpark! For all the talk on this board about 4 pillars and "being the market, not beating it" we have a lot of people beating the market's socks off! Are all of you high flyers energy investors, REITs or what?

This may be what I call the 'Las Vegas' syndrome. Have you ever talked to anyone that actually lost in Vegas? They all win! - I often wonder how those Casino's stay in business.

The big gainers here are obviously taking more risk. There may be some that did a lot worse, but they may not admit to it, as this beating the market is an ego thing as well. I admit I do not have any special skills to beat the market. Hence I index.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Re: Cramer's YTD Retrun

A broadly diversified portfolio would have beaten the S&P 500 this year. Small and mid-cap (especially mid-caps) did well again. REITS are up strongly as are most international stocks.

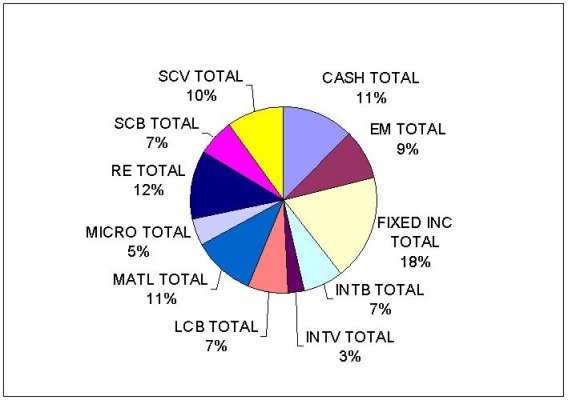

I have a 60 / 40 stock / fixed income allocation with a very high % of cash and have thus far beaten the S&P 500, albeit marginally. I think most people who are quoting 5-6% YTD returns are probably in the same camp having benefited from being "overweight" smaller capitalization stocks, international stocks, REITS and commodities (judging from other comments on the board). This seems pretty consistent with a well diversified, 4 pillars, approach.

Cut-throat has a point too. We probably won't hear from the individual stock picker who is down 10% on the year .

Laurence said:I may have not done worse, but same ballpark! For all the talk on this board about 4 pillars and "being the market, not beating it" we have a lot of people beating the market's socks off! Are all of you high flyers energy investors, REITs or what?

A broadly diversified portfolio would have beaten the S&P 500 this year. Small and mid-cap (especially mid-caps) did well again. REITS are up strongly as are most international stocks.

I have a 60 / 40 stock / fixed income allocation with a very high % of cash and have thus far beaten the S&P 500, albeit marginally. I think most people who are quoting 5-6% YTD returns are probably in the same camp having benefited from being "overweight" smaller capitalization stocks, international stocks, REITS and commodities (judging from other comments on the board). This seems pretty consistent with a well diversified, 4 pillars, approach.

Cut-throat has a point too. We probably won't hear from the individual stock picker who is down 10% on the year .

Similar threads

- Replies

- 24

- Views

- 4K