kcowan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

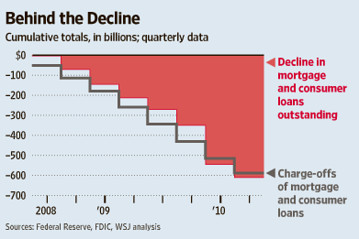

Just when we might think that the US consumer has reformed their borrowing ways, here is the main reason for the decline in household indebtedness:

Defaults Account for Most of Pared Down Debt - Real Time Economics - WSJ

Defaults Account for Most of Pared Down Debt - Real Time Economics - WSJ