Not a philosophical question, although interesting!

I have always read that of the market does "well" in the first few years of your retirement, you are much better off. But I am not sure what "well" means: 10%, 15%, keeping your bottom line stable rather than going down? And what is meant by a "few" years--2, 5?

I have a couple of part-time jobs and am pondering how long I will keep each. Adored Spouse has the same situation.

Of course these are fuzzy words. Any answer requires some arbitrary cut-off.

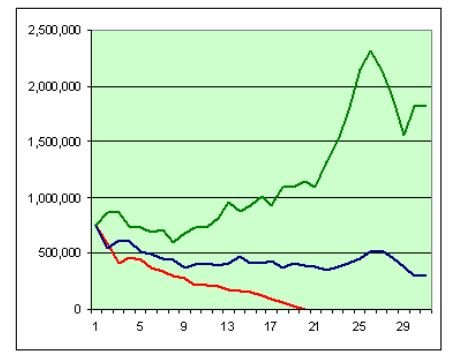

I used ******** with the default assumptions - $1 million portfolio, $40k CPI adjusted withdrawals, 75/25 stocks/bonds, 30 year horizon, 115 historical starting points.

I compared CPI-adjusted ending portfolios for the first 5 years to the lowest CPI-adjusted portfolios over the 30 year period.

There were 5 failures - ending portfolio below $0. Looking at the lowest of the first 5 years for each of these scenarios, those lowest numbers varied between $755k and $900k. i.e. If the worst ending year in the first 5 was better than $900k, then the portfolio survived the 30 years.

Being a little more general, let:

Low5 = lowest ending value in first 5 years

Low30 = lowest ending value in any of the 30 years.

There were 56 cases where Low5 was below $900k.

In those 56 cases, 21 would have Low30 below $400k,

and of those 21, 5 would have Low30 below $0.

There were 59 cases where Low5 was above $900k.

In those 59 cases, 3 would have Low30 below $400k,

and none of those 3 would have Low30 below $0.

I didn't look at what it took in terms of yields to get an ending value below $900k in the first 5 years. It seems like a constant real return of 2.2% would be right on the border. But, there are obviously many patterns of variable returns that would do it.