The value of the dollar is a very difficult subject to get your arms around. The exchange rate is set by the FOREX, not by real purchasing power. I live in Indonesia and the dollar has fallen 25% since May. That's crazy. Why should a dollar be 25% weaker in 6 months? Suddenly the price of a HP ink cartridge is 25% cheaper to local people. Why? Because currency traders are speculating with the numbers. So if the dollar is going to tank, that is good luck for Indonesian people (but bad luck for me). But you can't tell me the actual

value of the ink cartridge has changed anywhere!

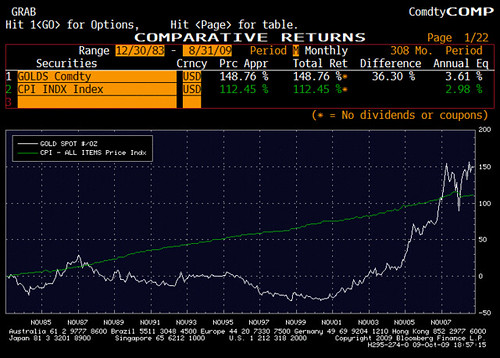

Do you think gold is a hedge against inflation? I remember in 1980 when an ounce of gold hit $850 per ounce. Adjusted for inflation, in 2008, that same ounce of gold should be [SIZE=+1]$

2193.25 [/SIZE]per ounce! So gold can be a terrible investment. Look at this chart.. does that look stable to you?

Another thing to consider... if you were a citizen of any other country in the world, let's say China or Russia, and you wanted to keep your money safe, where would you put it? Because China and Russia are unstable countries where the Government (sort of) controls the exchange rate of money, wouldn't you want your money in dollars? Think about that.

To almost everybody in the world, the US dollar is still the best place to keep your money because the US is rock solid stable. If you think the dollar is going to "tank", what logic can anybody possibly use to think the Chinese yuan or the Russian ruble or the EU euro is going to be stable?

We saw what happened when a year ago when the world markets crashed... everybody flocked to the US dollar and ran away from the other currencies. As much as the national debt is rising, and the unemployment rate is raising, the US government is not going to be torn apart by some revolution. Meanwhile, the movement toward democracy could bring down the Communist Chinese at any time; or if Russia tries to revert back to its old socialist ways; these governments could easily tumble.

Simply put, no country is nearly as stable as the United States and the US dollar.