timemoveson

Recycles dryer sheets

- Joined

- Jul 8, 2014

- Messages

- 153

Taking it out of order...

I 100% agree with you on that. I'll just add that it is helpful when people present the thought process behind their opinion. It's usually pretty hard to get anything useful from the opinion alone.

I'm not sure what "clear bias" you are talking about, so I guess it's not clear? And to explain, yes, to me your comment was in vacuum. You said:

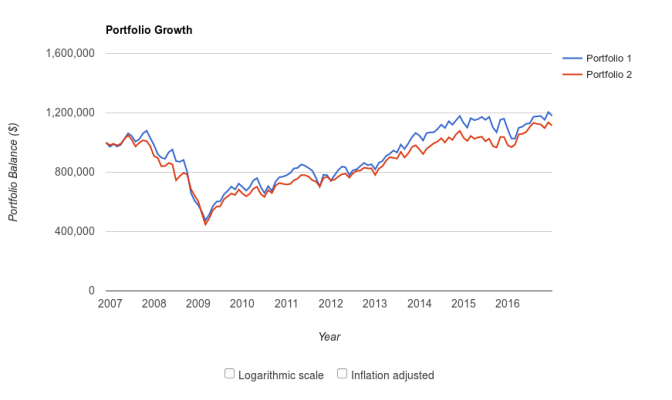

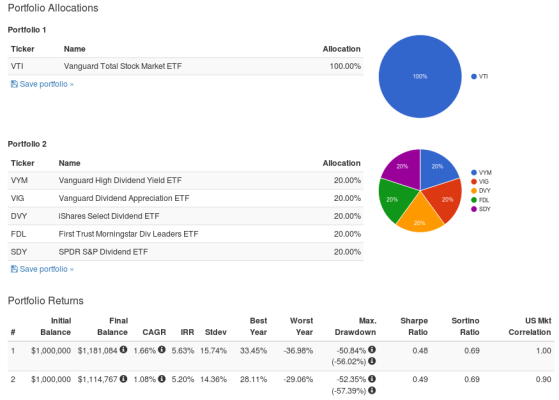

Without putting that in %, or providing the portfolio amount so we can put it in %, it's pretty meaningless, and it can be done without restricting yourself to dividend payers. In practical terms, OK, a portfolio made up of higher than average dividend rate stocks would kick off more income (w/o selling anything) than a broad-based index of stocks. But that only means one might decide to sell off some of the stock fund from time to time (like once per year) to make up the difference. That also provides a good time to re-balance an AA if desired.

In practical terms, making a sale once a year isn't a meaningful amount of effort, so to me, your "doing absolutely nothing" comment strikes me as more "dogma" and "bias" - just what you accuse the forum of in general?

There's nothing "wrong" with you deciding you want to focus on dividend payers, and I'm certainly not going to try to convince you otherwise. But I am usually tempted to respond when someone makes a post that seems to indicate "their way" has clear advantages, when the data doesn't back it up. That's not "doctrine" at all, that's letting the numbers speak.

-ERD50

Good challenge, no problem. I'm happy if you're happy.

About $7.5M working for me, 4% yield per annum, roughly 70% common stock, 5% preferred, 5% REITs, and 20% privately placed fixed income. Perpetual construct.

I think I may have more choices than do others. Will adapt as needed just like you.

I had to think hard about my strategy and the almost $500K I passed up in order to pursue a so called "safe" yield. After some very difficult consideration, I decided to stand fast. As was mentioned earlier, if the market goes up, I get paid every month and if the market goes down, I still get paid. Plus, I expect to over-perform when the market finally corrects.

I had to think hard about my strategy and the almost $500K I passed up in order to pursue a so called "safe" yield. After some very difficult consideration, I decided to stand fast. As was mentioned earlier, if the market goes up, I get paid every month and if the market goes down, I still get paid. Plus, I expect to over-perform when the market finally corrects.