|

|

02-09-2018, 10:05 PM

02-09-2018, 10:05 PM

|

#541

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Quote: Quote:

Originally Posted by NW-Bound

Stock valuation (P/E) usually goes down if and when interest rate rises. People who sell may be able to buy them back cheaper. If that happens, they get the last laugh. I won't.

|

Yep.

But Iíll ultimately be rebalancing, so itís OK.

__________________

Retired since summer 1999.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

02-09-2018, 11:01 PM

02-09-2018, 11:01 PM

|

#542

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

I have a different reason to hold my shares though.

If a $100 share you hold now is repriced to $90 due to P/E contraction, you have lost $10. I do not see how rebalancing will help.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

02-09-2018, 11:11 PM

02-09-2018, 11:11 PM

|

#543

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Quote: Quote:

Originally Posted by NW-Bound

I have a different reason to hold my shares though.

If a $100 share you hold now is repriced to $90 due to P/E contraction, you have lost $10. I do not see how rebalancing will help.

|

So when the price drops rebalancing means you buy more of it from your other assets such as cash of bonds if the bonds havenít dropped as much.

Sure timing is superior. But we know how incredibly difficult (impossible?) it is to sell all at the top, wait the right amount of time, and buy at the bottom. But folks wonít stop trying to do jut that.

__________________

Retired since summer 1999.

|

|

|

02-09-2018, 11:20 PM

02-09-2018, 11:20 PM

|

#544

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Rebalancing may help going forward, but when your shares have lost their values, buying more of new ones does not bring up the value of the existing shares you have now. They are still stuck at $90.

At this point, the shares are already down 10%. If they are stuck there at $90, you and I have lost. It's too late for market timing. We already miss it. The sellers have won.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

02-09-2018, 11:38 PM

02-09-2018, 11:38 PM

|

#545

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Quote: Quote:

Originally Posted by NW-Bound

Rebalancing may help going forward, but when your shares have lost their values, buying more of new ones does not bring up the value of the existing shares you have now. They are still stuck at $90.

At this point, the shares are already down 10%. If they are stuck there at $90, you and I have lost. It's too late for market timing. We already miss it. The sellers have won.

|

The sellers only win if they get back in before prices go back up above where they sold. And if what they wait in yields as much.

Not that many timers sell at a local top. Many sell on the way up. Many sell way too early.

__________________

Retired since summer 1999.

|

|

|

02-10-2018, 12:09 AM

02-10-2018, 12:09 AM

|

#546

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

If I were one of those who sold, I would buy back now, and have 10% more shares. In another thread by RayinPenn who sold a bunch earlier, I showed that he could buy in now and got 4.5%.

But all that does not mean anything. If people who bail never buy back, it's not my problem. I did not sell, so I do not have to worry about buying back.

What I was trying to say is perhaps the market has priced in the higher inflation rate and the lower P/E. If so, it's not a correction, meaning it will not bounce back. It's here to stay. Damage is done.

At this point, I will just stay in. Maybe the pricing action is overdone, and that the stocks do not deserve a 10% haircut. Maybe the earnings will improve sufficiently this year to keep propelling the price forward.

People should be content with the price in the immediate future being where it is now. It may not bounce back.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

02-10-2018, 12:32 AM

02-10-2018, 12:32 AM

|

#547

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2015

Posts: 2,232

|

Quote: Quote:

Originally Posted by audreyh1

When interest rates get high enough, some folks decide to hang out in bonds instead.

I think there were folks piling in who hadnít had experience with volatility. They got a little taste of why equities arenít clear sailing.

Although memories sure are short! That Dec 2015 to Jan 2016 was pretty nasty and scary. Folks sure forgot about it quick though.

|

agree, but I don't think interest rates are high enough to make people happy parking what they pulled out of equities there for very long. Between not making enough to offset inflation, and the risk of principal in the face of future interest rate hikes, I think they'll hope for a quick dip, and then buy back in.

I think. Maybe.

|

|

|

02-10-2018, 05:18 AM

02-10-2018, 05:18 AM

|

#548

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

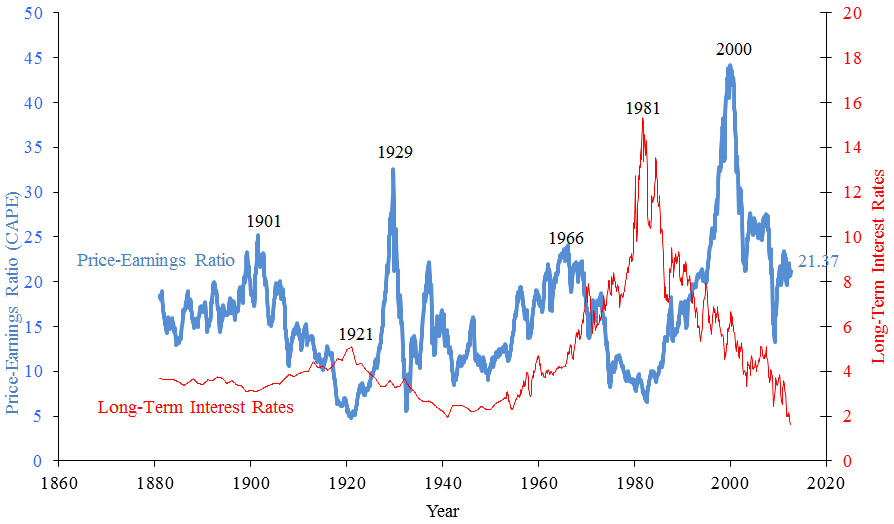

In order to remind myself the effects of interest rate/inflation on the stock P/E, I looked at the historical chart for both.

In 1980, I paid 14% mortgage rate for my 1st home. The stock P/E then was around 8. Good grief! God forbid if we ever come back to that point.

But the low interest rate that we have had in the last decade is not normal. If it returns to the historical average, then should we not assume that the P/E will also get re-normalized? To its average value of around 16?

Everybody hopes that it happens gradually over a number of years to avoid shock to the system. Don't get confused: there is no market timing or rebalancing to counteract this. This is what Bogle and Shiller have been preparing us for a while.

In an interview in Oct 2017, Bogle was thinking that this P/E contraction will subtract 2%/yr out of the stock return on the average for the next 10 years. The market is never orderly however. Did it just take out its pound of flesh for the next 5 years?  Now that it already happened, I hope the monster is satisfied for a while. And that's why I am staying in the market.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

02-10-2018, 05:33 AM

02-10-2018, 05:33 AM

|

#549

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2011

Posts: 8,418

|

Quote: Quote:

Originally Posted by jim584672

I have been watching the market minute by minute for this whole move. My gut feeling is this is something major. I hope I am wrong. I fear the worst may be ahead of us.

|

For many of us this could soon be the buying opportunity we've been long waiting for. Hang in there. This should all settle down in a week or so IMO.

__________________

Living well is the best revenge!

Retired @ 52 in 2005

|

|

|

02-10-2018, 05:56 AM

02-10-2018, 05:56 AM

|

#550

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

One more thing I forgot to mention about P/E: effect of expected growth.

As of Oct 2017, the expected earning of the S&P was such that the 2018 forward P/E is 19. Barring any calamity that prevents that from happening, the recent price cut of 10%, if it stays, means the forward P/E will be 17.

That's reasonable. Another reason for me to stay.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

02-10-2018, 06:08 AM

02-10-2018, 06:08 AM

|

#551

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Posts: 11,702

|

Quote: Quote:

Originally Posted by audreyh1

Hence the snowball. Itís like a game of musical chairs.

Personally Iím glad to see a big shake up and get some of that complacency removed, and get a little fear into those inexperienced investors.

|

Agree. I've been waiting for this "unstable bottle" to topple over.

Although 2008-09 seem like yesterday to many of us, the fact is that a whole new class of investor has joined in since and they haven't seen a correction or bear. Additionally, many of us have amnesia. We need a booster shot.

This is also the first good test of the new class of robo-adviser investors. Reading about how markets work is different than experiencing it.

For me, it was '87. It was the first time I had recurring money in the market (401k), and I have to say, '87 was quite a shock.

|

|

|

02-10-2018, 06:12 AM

02-10-2018, 06:12 AM

|

#552

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2016

Posts: 9,521

|

Quote: Quote:

Originally Posted by audreyh1

When interest rates get high enough, some folks decide to hang out in bonds instead.

I think there were folks piling in who hadnít had experience with volatility. They got a little taste of why equities arenít clear sailing.

Although memories sure are short! That Dec 2015 to Jan 2016 was pretty nasty and scary. Folks sure forgot about it quick though.

|

True >>> I planned on retiring early 2016 and I did but was some nervous days. Now looking back it was a great time to jump.

|

|

|

02-10-2018, 06:14 AM

02-10-2018, 06:14 AM

|

#553

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Posts: 11,702

|

Quote: Quote:

Originally Posted by audreyh1

Although memories sure are short! That Dec 2015 to Jan 2016 was pretty nasty and scary. Folks sure forgot about it quick though.

|

It was, but for some reason this one felt worse. When I look at the chart, the 15-16 slope up to the pullback was lower and there was a bit of chaos before the drop.

For this pullback, it was just a day after day after day slope up and then BAM.

|

|

|

02-10-2018, 06:38 AM

02-10-2018, 06:38 AM

|

#554

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2002

Location: Chattanooga

Posts: 3,893

|

Quote: Quote:

Originally Posted by Gumby

I must admit that I do not understand what is driving the violent swings in the market this past week. It seems that a derivative security designed to respond to changes in volatility is actually driving that volatility. And, in an even more bizarre set of circumstances, driving the trading value of actual equities whose changes are the measure of that volatility.

Yes, I know that P/Es have advanced sharply recently and that interest rates have recently spiked. Absent other things, that might drive a correction in the market until we get values more in line with underlying fundamentals. But that still doesn't explain the unprecedented volatility.

Given that I don''t know why things are happening, I do not feel I have adequate knowledge to formulate a response. So I am sitting tight. I am still as rich as I was at Thanksgiving, which was good enough then and still good enough now.

|

Here you go, Cramer has all the answers; https://www.cnbc.com/2018/02/08/cram...hoo&yptr=yahoo

__________________

Earning money is an action, saving money is a behavior, growing money takes a well diversified portfolio and the discipline to ignore market swings.

|

|

|

02-10-2018, 07:12 AM

02-10-2018, 07:12 AM

|

#555

|

|

Administrator

Join Date: Apr 2006

Posts: 23,038

|

What a bizarre positive feedback loop. You sell stocks to cover your losses on the inverse VIX instrument, which drives VIX even higher, which makes your position even worse, so you have to sell more stocks. Who ever thought this was a good idea?

__________________

Living an analog life in the Digital Age.

|

|

|

02-10-2018, 07:14 AM

02-10-2018, 07:14 AM

|

#556

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Quote: Quote:

Originally Posted by JoeWras

It was, but for some reason this one felt worse. When I look at the chart, the 15-16 slope up to the pullback was lower and there was a bit of chaos before the drop.

For this pullback, it was just a day after day after day slope up and then BAM.

|

That felt way worse to me. My portfolio hadn’t recovered from the prior year withdrawal yet, and I had just pulled out another years income, so portfolio had been shrinking. I remember looking at what my income would be if we took another 20% equity hit just to know in case I had to deal with reduced income.

Oil prices had collapsed very suddenly. The economic effects seemed widespread and ominous. Uncertainty was very high.

Our portfolio is so much way higher over the past year that we could give up most of the 2017 gains and I’d still feel OK (knock on wood!).

I guess I’ve been expecting some kind of blow-off top, so I feel some relief that it has finally happened. And would feel better if it went farther.

If 10-year rate gets to 3.25% anytime soon, I’d fell like this phase was pretty much done and expect moves above that to be reversed, at least for the short term. A 10 year yield that high will have an economic effect as it will weigh on housing and corporate financing. Whether that drives things out of balance enough for me torebalance, who knows.

__________________

Retired since summer 1999.

|

|

|

02-10-2018, 07:16 AM

02-10-2018, 07:16 AM

|

#557

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Quote: Quote:

Originally Posted by Gumby

What a bizarre positive feedback loop. You sell stocks to cover your losses on the inverse VIX instrument, which drives VIX even higher, which makes your position even worse, so you have to sell more stocks. Who ever thought this was a good idea?

|

Exactly! Absolutely nuts!

Yet people made “easy” money on these inverse VIX vehicles for well over a year. Thus the piling in.

When the markets get overextended, we often find out later how much of it was driven by buying on margin and dangerous investment vehicles.

__________________

Retired since summer 1999.

|

|

|

02-10-2018, 07:19 AM

02-10-2018, 07:19 AM

|

#558

|

|

Full time employment: Posting here.

Join Date: Oct 2017

Posts: 717

|

Quote: Quote:

Originally Posted by LOL!

Maybe. Maybe not.

There were people not paying attention today, so this weekend they will have a chance to see what happened to their portfolios.

One group will say, "OMG! I lost a ton and need to get out."

Another group will say, "OMG! Buying opportunity!"

We won't know which is the larger group until next week.  |

Totally agree. Its been funny hearing the talking heads on TV and even acquaintances at work or elsewhere breathlessly talking about the recent volatility in the market and pontificating on what is driving it. I simply smile, look for more buy opportunities and rebalance if necessary...

|

|

|

02-10-2018, 07:27 AM

02-10-2018, 07:27 AM

|

#559

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Posts: 11,702

|

Quote: Quote:

Originally Posted by audreyh1

That felt way worse to me. My portfolio hadnít recovered from the prior year withdrawal yet, and I had just pulled out another years income, so portfolio had been shrinking. I remember looking at what my income would be if we took another 20% equity hit just to know in case I had to deal with reduced income.

Oil prices had collapsed very suddenly. The economic effects seemed widespread and ominous. Uncertainty was very high.

|

You see, in my little brain, the reduction in gas prices was nice.

I knew WHY oil collapse was bad, but for my little world, it was nice. I know, I know, stupid.

On top of that, I visited Greece at this time, and the dollar exchange was awesome. More "all about me" nice things. And besides, the Greek people were on the whole of the attitude of: whatever, let's sit down, relax, and have some wine.

But, yeah, it wasn't a pleasant time overall when you think about it.

|

|

|

02-10-2018, 07:45 AM

02-10-2018, 07:45 AM

|

#560

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Quote: Quote:

Originally Posted by JoeWras

You see, in my little brain, the reduction in gas prices was nice.

I knew WHY oil collapse was bad, but for my little world, it was nice. I know, I know, stupid.

On top of that, I visited Greece at this time, and the dollar exchange was awesome. More "all about me" nice things. And besides, the Greek people were on the whole of the attitude of: whatever, let's sit down, relax, and have some wine.

But, yeah, it wasn't a pleasant time overall when you think about it.

|

Oh sure, it was great for my pocket book and also meant inflation would stay low for quite a while. In fact I think the Fed was worried about deflation and thus took a year before resuming their Fed Rate increases.

And the exchange rate was very nice in 2016.

But in terms of my long-term investments, things were looking a bit bleak there in Jan and Feb. I hoped that the economic effect would be muted, but we didn’t find out the answer until later.

__________________

Retired since summer 1999.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|