copyright1997reloaded

Thinks s/he gets paid by the post

Something baffling I noticed is usually on a sell off "safe havens" like Treasuries, gold, and short term notes should rise. But this time none of these are going higher. The 10 year seems to be steady at 2.85%. Gold is down. Rates are down very slightly. I guess no one is in a panic yet.

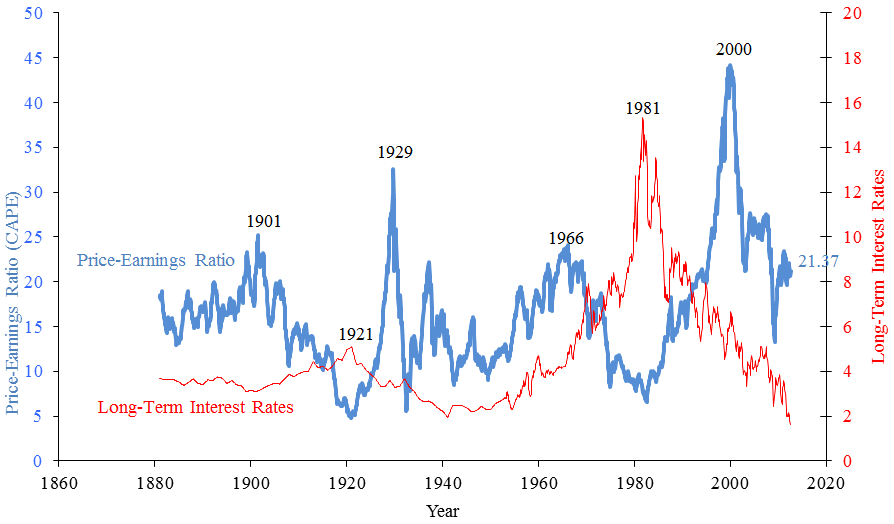

Unless all of the asset classes are in bubble territory. Has the 38 year downtren d in 10-year rates been broken? 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends

Remember, the "turd in the punch bowl" of our equities up up up party was when wages increased more than expected, thus increasing inflation expectations and driving the 2 year note to 2.8+%.