Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

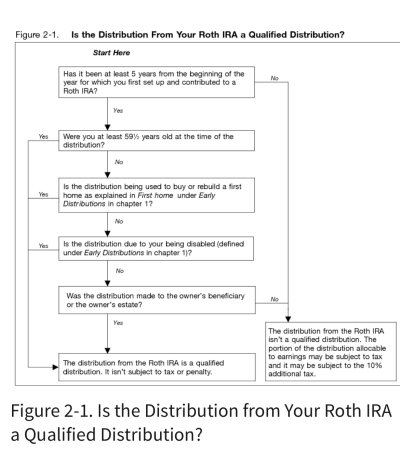

For some reason I am finding it confusing. There seem to be quite a few articles online that summarize the 5-year rule for Roth contributions, without noting there's a different rule for conversions (and inherited IRAs)?

I am (well) over 59-1/2. My Roth IRA is entirely conversions from a TIRA, no contributions. My first conversion was Dec 2019. I have made 4 quarterly conversions in 2020 and 2021. I plan to do quarterly conversions thru 2024 and then stop at age 70.

Unlike the 5-year rule for contributions, for Roth conversions I gather each conversion is subject to a new 5 year period. However, I also gather I can aggregate quarterly conversions as all in that year (e.g. 2020) and I don't have to have four 5 year periods from 2020, just one for each year (my read from IRA 590b). [If not, I won't do quarterly anymore] I don't plan to take any distributions before I've satisfied the 5 year rule.

So if I do conversions from 2019 thru 2024 and then stop (at age 70). If numbers help, let's say $50K in 2019 and $100K each year from 2020 thru 2024.

I am (well) over 59-1/2. My Roth IRA is entirely conversions from a TIRA, no contributions. My first conversion was Dec 2019. I have made 4 quarterly conversions in 2020 and 2021. I plan to do quarterly conversions thru 2024 and then stop at age 70.

Unlike the 5-year rule for contributions, for Roth conversions I gather each conversion is subject to a new 5 year period. However, I also gather I can aggregate quarterly conversions as all in that year (e.g. 2020) and I don't have to have four 5 year periods from 2020, just one for each year (my read from IRA 590b). [If not, I won't do quarterly anymore] I don't plan to take any distributions before I've satisfied the 5 year rule.

So if I do conversions from 2019 thru 2024 and then stop (at age 70). If numbers help, let's say $50K in 2019 and $100K each year from 2020 thru 2024.

- In Jan 2024, I can take my first qualified $50K distribution (+gains pro-rated? or losses).

- In Jan 2025, remaining 2019 (if I took less than $50K) plus 2020 ($100K).

- In Jan 2026, remaining plus 2021 ($100K).

- In Jan 2027, remaining plus 2022 ($100K).

- In Jan 2028, remaining plus 2023 ($100K).

- In Jan 2029, remaining plus 2024 ($100K). IOW, all remaining has met the Roth conversion 5-year rule every year thereafter, 2030...

Motley Fool said:2. Roth conversions

There's also a separate five-year rule that applies only to those who convert other types of retirement accounts into Roth IRAs. Here, the idea of the rule is to prevent people from using Roth conversions to get penalty-free access to their traditional retirement accounts.

This five-year rule also starts the clock on Jan. 1 of the year in which you do the conversion. As a result, those who convert late in the year only have to wait a bit longer than four years before taking withdrawals.

However, this five-year rule is different in that it applies separately to each Roth conversion you do. Each new conversion starts its own five-year clock, and you'll need to account for multiple conversions to make sure you don't take out too much money too soon.

Note that the five-year rule applies equally to Roth conversions for both pre-tax and after-tax funds in a traditional IRA. That means, if you're using the backdoor Roth IRA strategy every year, your "Roth contributions" are really conversions, and you can't withdraw them for five years without penalty.

Last edited: