What's been bothering me about most SWR studies i've seen so far (specifically Bengen & Pfau) is that it is geared towards people with a rather limited future lifespan, with a typical maximum of 30 years.

This means that you can draw from two components derived from your savings:

Specifically: once you go below a withdrawal rate of roughly 3.5% I can guarantee you a 100% survival rate for 30 years: buy TIPS and you are done! For an early retiree tough, it would spell certain disaster after those 30 years. Early retirees cannot rely on the first component.

At the same time, it is clearly shown in those studies that the returns of the first 10 years practically fully determine whether you'll manage a long financially sound retirement.

So why not go for a different approach better suited for long-lived people and very early retirees?

For example: Look at how much *real* return I can expect in the coming 10 years?

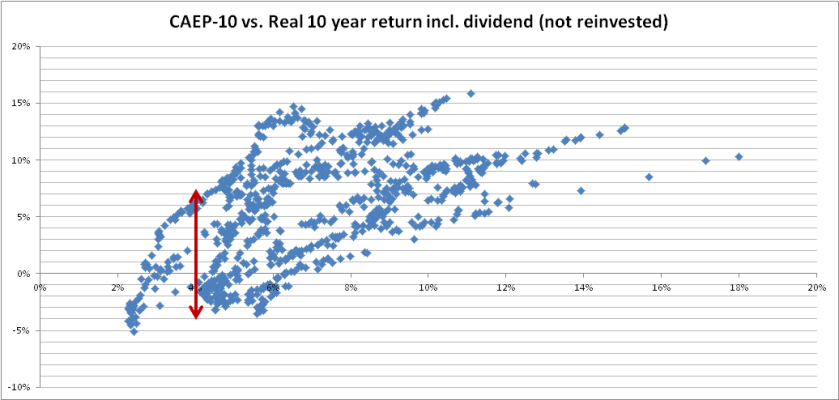

Well, I did just that, and went one step further:I put it alongside the CAPE-10 (inverted) and low and behold, the following picture comes out (I'll show it in the next post, struggling to include it.)

The red arrow is at the current CAPE-10: 25. I did the math and it seems you'll only have a 20% chance of getting at least a real 4% return on stocks starting from valuations above this level

Note that this is just a preliminary analysis, using shiller numbers from 1929 until 2012 (roughly), and it does not reinvest dividends so it's slightly off. I can do something much better and complete if the forum finds this useful (and if it hasn't been done before). Let me know.

This means that you can draw from two components derived from your savings:

- Principal (the balance sheet)

- Total real return from your portfolio (P&L)

Specifically: once you go below a withdrawal rate of roughly 3.5% I can guarantee you a 100% survival rate for 30 years: buy TIPS and you are done! For an early retiree tough, it would spell certain disaster after those 30 years. Early retirees cannot rely on the first component.

At the same time, it is clearly shown in those studies that the returns of the first 10 years practically fully determine whether you'll manage a long financially sound retirement.

So why not go for a different approach better suited for long-lived people and very early retirees?

For example: Look at how much *real* return I can expect in the coming 10 years?

Well, I did just that, and went one step further:I put it alongside the CAPE-10 (inverted) and low and behold, the following picture comes out (I'll show it in the next post, struggling to include it.)

The red arrow is at the current CAPE-10: 25. I did the math and it seems you'll only have a 20% chance of getting at least a real 4% return on stocks starting from valuations above this level

Note that this is just a preliminary analysis, using shiller numbers from 1929 until 2012 (roughly), and it does not reinvest dividends so it's slightly off. I can do something much better and complete if the forum finds this useful (and if it hasn't been done before). Let me know.

Last edited: