USGrant1962

Thinks s/he gets paid by the post

That tax cut was paid for by incurring more debt. The US Treasury recently announced that US debt has gone up 17% in 2018. A large part of that is due to the decrease in tax revenues going into the treasury. The shortfall of course is made up by printing bonds which are then sold to the Chinese. So you can thank them for your tax windfall.

Hmm, there is so much wrong here I don't know where to start. How about the first sentence - arguably true!

Second sentence - in FY2018 debt went from $20.245T to $21.516T - plus $1.271T for a 6.27% increase. Not good, but hardly 17%.

Data: https://www.treasurydirect.gov/govt/reports/pd/histdebt/histdebt_histo5.htm

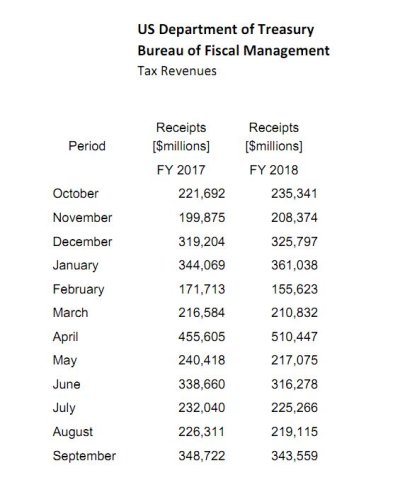

Third sentence - Federal revenue (receipts) increased from 2017 to 2018, and are forecast to increase as far as the eye can see. Spending is increasing faster. In 2018 receipts increased by $24B, and outlays increased by $232B. The TCJA is forecasted to "cost" between $1T and $1.5T in receipts over the next 10 years, so say $150B in 2018 - add that to $24B that receipts actually increased and you are still $58B short of the spending increase.

Data: see page 117 https://www.whitehouse.gov/wp-content/uploads/2018/02/budget-fy2019.pdf

Third sentence - China owns about $1.2T of our $21T debt, less than 6%. The "China owns us" boogeyman is just that. About 70% of the U.S. debt is owned by Americans and American institutions.

Data: https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

Fourth sentence - so keeping one's own money is a windfall? Hmmm.....