Good Morning FIRE's. Always look forward to discussions and very much value people's feedback.

Planning on retiring 31 Dec 14. Somewhat scarey. High paying job, won't get back. Enjoy people, but not the stress, hrs. Impacting health. Take too much time from enjoying life. Think I can RE.

Met with Edelman associate yesterday. Actually thought our pension and SS could handle basic expenses. Their numbers not so rosey. I was counting on BIG reduction in taxes, no more retirement savings. Today re-calculating, just my post retirement living expenses not matching theirs. Hmm.

Anyway - real question here is. I l liked what I heard with regards to establishing a strategy and sticking the course thru rebalancing. We got a free copy of Lies about Money and had good portfolio guidance and how to allocate based on needs, timeline, risk amongst US Stocks, International Stocks, Bonds, and Hedge Positions.

They pushed for further diversification using large number of ETFs in different sub classes like Large Cap Value, Large Cap Growth, Small Cap, ... within US Stocks. Similar for International Stocks, Bonds, and Hedge Positions.

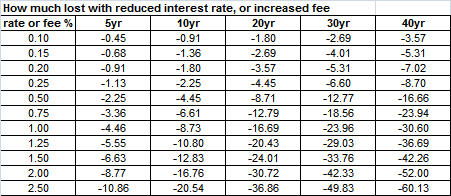

My question is - can a normal FIRE'er accomplish somewhat similar diversification using Vanguard mutual funds in the different classes or worth the 1.4% (approx) fee (ouch).

Appreciate anyone who has used/heard of Edelman or doing just that on their own. And did your taxes/expenses go down after retiring

? Still can't figure their numbers.

Thank you FIRE'ers.

Kannon