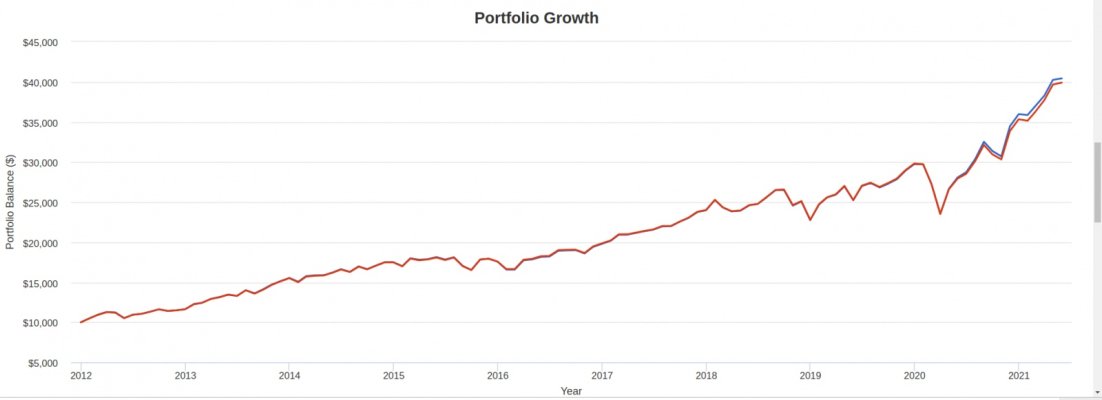

Here is a graph of the returns of VTSAX and a 2 fund portfolio of FXAIX + VSCPX 85%/15%. As you can see, the performance is virtually identical over the 10 year span. The two lines exactly overlay each other until they diverge just enough to see the separation in the last 6 months. They move in lockstep. That is because VTSAX (the total USA stock index) is made up of virtually the same components as the 85/15 mix of S&P500 + USA small cap index.

The broader question is what do you want for a portfolio ? The total stock index is a very popular choice for a portfolio foundation, but there is nothing magic about it. You would give up very little by choosing just the S&P500 index alone. It depends on how much you value the slightly greater simplicity of a single fund verses the slightly greater diversification of having the total stock market index represented by two funds. Kind of a coin toss and the eventual outcome is likely to be very close to the same. Your choice.

You can generate such portfolio comparisons using the site Portfolio Visualizer.

You might play with the interface using popular Total USA stock funds like VTSAX, VTI, SCHB, ITOT. They are all functionally the same thing, just different brands of the same commodity.

https://www.portfoliovisualizer.com/