Carpediem

Full time employment: Posting here.

- Joined

- Aug 26, 2016

- Messages

- 770

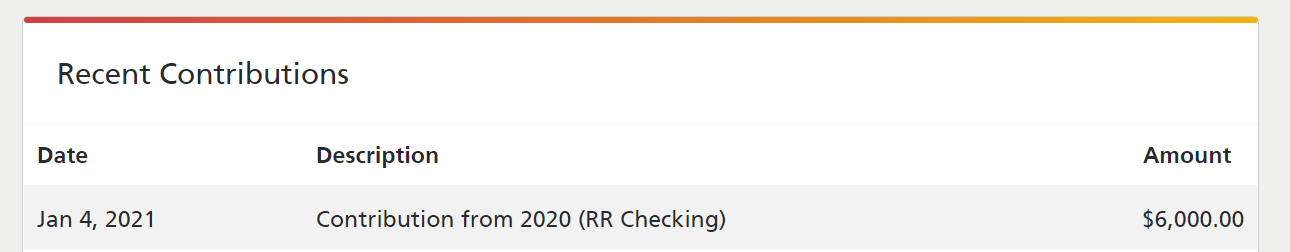

I initiated a HSA contribution at the end of Dec but Optum Bank didn't deposit the contribution until Jan 4. Does it still count as a 2020 HSA contribution?

I think the answer is 'yes - you can contribute to 2020 until Apr 2021' but I thought I should confirm with people smarter than me.

Thank you.

I think the answer is 'yes - you can contribute to 2020 until Apr 2021' but I thought I should confirm with people smarter than me.

Thank you.