I watched this short,

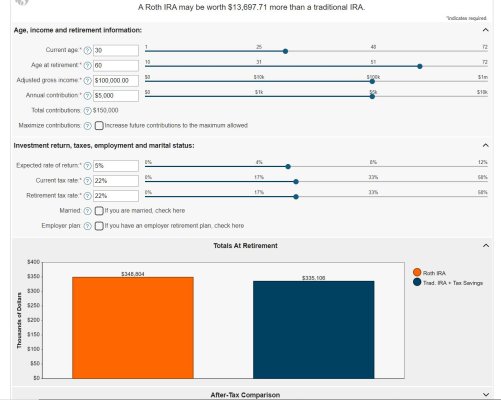

it concludes, a Roth ends with a higher balance, even with the same contribution. He shows 3 examples in the original from a Voya calculator. All show the Roth better. I'd like to correct it (someone tried) but I'm not sure what it is calculating and I think it misses the tax that you save that could/should be invested.

Does anyone have a good argument about tIRA vs Roth with equal tax rates, or a page with numbers to prove the arguement?

What am I missing that makes the Roth look so much better or what is the calculator missing.

Here's the longer version, 9 minutes.

it concludes, a Roth ends with a higher balance, even with the same contribution. He shows 3 examples in the original from a Voya calculator. All show the Roth better. I'd like to correct it (someone tried) but I'm not sure what it is calculating and I think it misses the tax that you save that could/should be invested.

Does anyone have a good argument about tIRA vs Roth with equal tax rates, or a page with numbers to prove the arguement?

What am I missing that makes the Roth look so much better or what is the calculator missing.

Here's the longer version, 9 minutes.