Will there be a waiver of penalties this year for underpayment of taxes you think?

I had only applied our 2019 refund to our 2020 taxes but now I just made $60,000+ on Stemline stock and will have to pay back all of our ACA subsidy plus a lot of short term gains.

I could really stimulate the economy if I didn't have to send in $$$ in estimated payments this year.

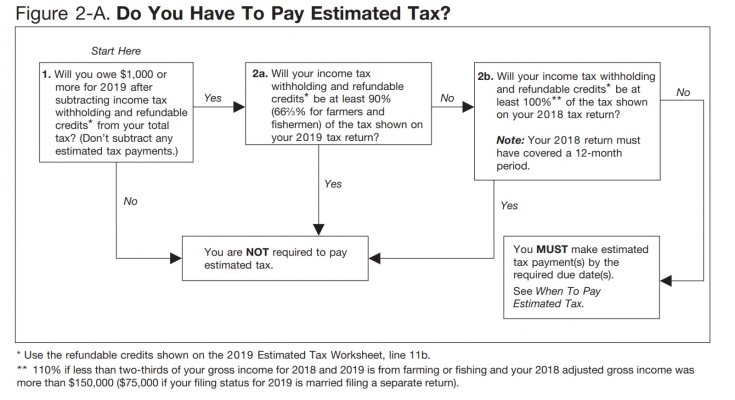

Wait....I was just reading...so if last year we had a refund (only due to the fact that I had made $8,000 in estimated tax payments), we won't owe any penalty this year even if we don't make payments?

I don't think they'll automatically waive penalties for underpayment. That hasn't been in any of the legislative discussion. You can always request a waiver if you're affected by a disaster or unusual circumstances, and I expect "I came down with Covid-19" or some variation on that would qualify.

Whether you got a refund on your 2019 return is not related to penalties on your 2020 return. You need to hit one of the safe harbors.