I think there are a number of issues to consider, and we confuse ourselves when we try to group them all together.

Categories-

An Index Fund that is supposed to track a specific broad benchmark. If you have multiple funds that are supposed to track the total market (or S&P 500), then the lowest expense ratio should prevail. As expense ratios have been squeezed down to relatively insignificant amounts in the past few years, there should be little difference between an S&P fund at any of the low exp ratio brokerages. If there is a difference, then we start to ask why?

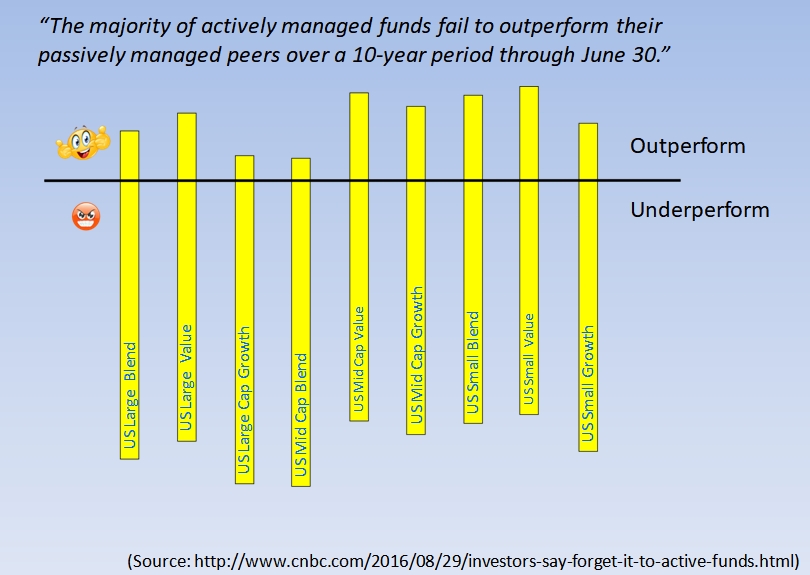

A mutual fund with a well known track record or manager- such as Magellan, or similar. The exact holdings may vary, but we are betting on a philosophy or a portfolio manager. The manager or philosophy may do very well, but being concentrated or not diversified introduces risk. The narrower the focus, the greater the opportunity for better (or worse) performance. A lot of studies say that there is no correlation, or magic formula for assuring success.

Specific stocks. Now we are placing our money on a very narrow selection of stocks believing that they will outperform the pack. Opportunities for boom or bust.

Many of us prefer to use a blend of funds to align with an asset allocation that we can tolerate. The couch potato approach says that we are willing to accept average returns. Many of us (myself included) have the bulk of our money in total market or index funds, with a bit of gambling money that we will put into narrower funds or individual stocks. My money in the Large Cap Growth fund is like that. It has done well the past few years, but there is no way that I will put all my eggs in that basket.