The performance of the market cannot be predicted in advance.

True. This is why stock picking fails in aggregate. It attempts to predict a future that is random.

The return of an index fund will always be the average return of the market. There is no chance of outperforming the market.

Actually, the index fund will underperform its benchmark by the amount of its costs, including trading costs (Possibly slightly offset by fees for lending securities or other ancillary activities). The average stock picker fund will also underperform by the amount of its costs, which are much higher. That is why index funds on average outperform stock pickers. William Sharpe explained this to us in his 1991 paper "

The Arithmetic of Active Management." Nothing has changed this arithmetic. Fama and French provided a statistical analysis that supports Sharpe in their 2010 paper "

Luck versus Skill in the Cross-Section of Mutual Fund Returns."

(Note there is something subtle but important here. An index fund must be compared to an appropriate benchmark. For a Russell 3000 total market fund, the comparison is indeed "the market." For an S&P 500 fund, though, the comparison is to a US large cap benchmark like the S&P 500. There is an increasingly-popular scam where active managers compare themselves to inappropriate benchmarks, like a small cap fund comparing itself to the Dow or to the S&P. Caveat emptor.)

An active fund does not need to outperform the index every year to outperform the index over 10 years. Depending on the margin, an active fund could win only a few years out of ten and still outperform the market over ten years.

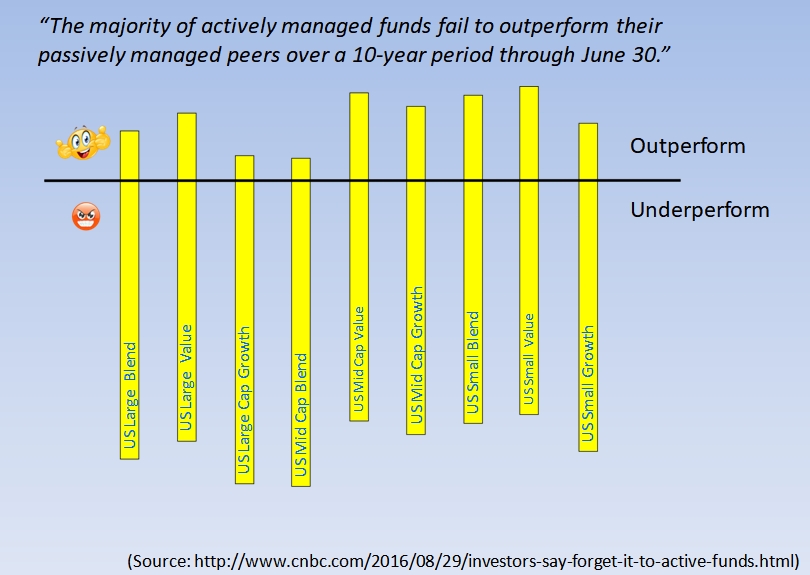

And ... right for the third time. Every six months the S&P SPIVA report card shows that a small fraction of active funds outperform for various periods of time. The longer the time period, the smaller the number of outperformers. IIRC the 10-year outperformers are about 5% +/- 2% of the total number of funds, depending on which SPIVA report you are look at. Said another way, a fund that is randomly selected at the beginning of a ten year period will have about one chance in twenty of outperforming over the period.

The last, and probably most important consideration to follow the above true statements is this: It is not possible to identify outperforming funds ahead of time. This is consistent with the theory that outperformance is primarily due to luck and not to skill, which Fama and French deal with in the above-mentioned paper.

Larry Swedroe, a writer that many here respect, also explains:

Research on Luck versus Skill in Mutual Fund Performance Highlights Active Management's Shortcomings It's worth a read. His last paragraph is:

"The choice is yours. You could try to beat overwhelming odds and attempt to find one of the few active mutual funds that will deliver future alpha. Or you could accept market returns by investing passively in the factors to which you desire exposure. The academic research shows that investing in passively managed funds is playing the winner’s game."