bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

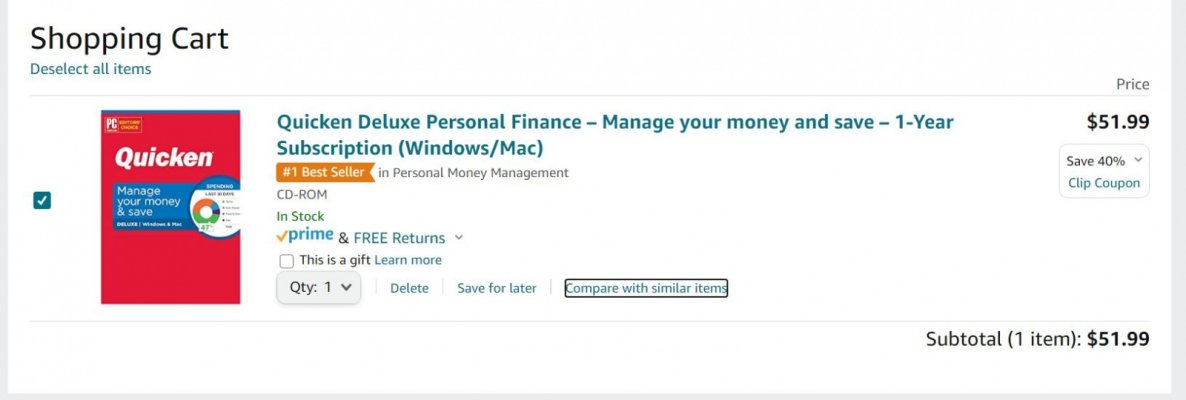

I know Quicken is very popular here, and I even bought it a few years ago after I learned that, to see if I might like it too.

Sadly, I hated it. It seemed so inflexible to me. I would probably hate Moneydance too, for the same reasons. I am the type who prefers to do these things in Excel, instead. But each to his own, and good luck with Moneydance!

I can't say I'm fond of the reporting directly out of Quicken, but the ability to source and aggregate the data it does great. I then have a series of spreadsheets that I use for my analysis. Things like tracking balances and changes over time, spending as well, and even reports to let me quickly summarize my income/tax situation -- got to stay below that ACA you know