Surewhitey

Thinks s/he gets paid by the post

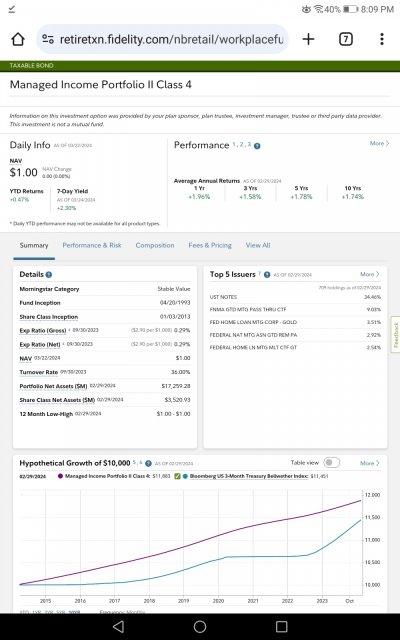

So wanted to move DW's biggest holding Fido MM to Vanguard MM (3% difference yld) & it would not let me. So called them & they said it was a competing fund & I'd have to move it to another fund for 90 days before moving it to the Vanguard MM.

I said "can't I just move all the other funds to the Vanguard MM & then the FIDO MM to the others?"... "yep" was his answer. Done. Seems sneaky and bad biz to do if the other fund is one of the options provided.

I said "can't I just move all the other funds to the Vanguard MM & then the FIDO MM to the others?"... "yep" was his answer. Done. Seems sneaky and bad biz to do if the other fund is one of the options provided.