Hi:

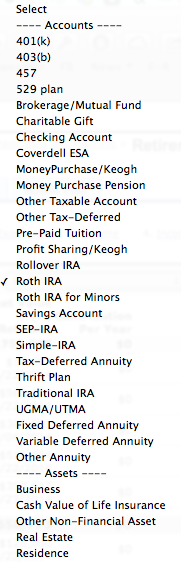

I do not have a Fidelity account, but I can use Fidelity's Retirement Income Planner without a Fidelity account. The RIP appears to account for federal and state taxes in its analysis. I have almost 20% of my investment portfolio in a ROTH IRA. I cannot see where I can identify this asset as a ROTH (so that it will not be considered taxable income) in the RIP calculator. Do you know how to do this?

Thanks.

I do not have a Fidelity account, but I can use Fidelity's Retirement Income Planner without a Fidelity account. The RIP appears to account for federal and state taxes in its analysis. I have almost 20% of my investment portfolio in a ROTH IRA. I cannot see where I can identify this asset as a ROTH (so that it will not be considered taxable income) in the RIP calculator. Do you know how to do this?

Thanks.