CRLLS

Thinks s/he gets paid by the post

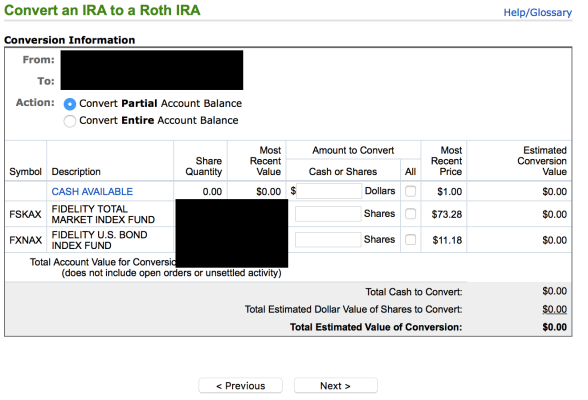

Yesterday I did my 1st Roth conversion. I went to my Fidelity account and filled out the blanks. Almost immediately, the number of mutual fund shares chosen moved from my Rollover to my Roth. My question is, what should I expect to see for documentation, both now and for tax purposes? If I look at my account history today, I see "x" shares moved, however there is no dollar amount shown. Being a MF, I'm not sure what the value per share actually was.

Further, I will have to pay theh taxes, of course. How is that actually executed? Is it done via the 1040ES form or some other document? The 1040ES worksheet really does not work for a Roth conversion. Do I just estimate the tax burden and send in payment with the 4th Qtr 1040ES form? Will I get dinged for not submitting the previous 1st thru 3rd Qtrs? I'm a bit gun shy because I've been fined in earlier years (only a few dollars) for being a couple of days late on one qtr's payment.

I've searched here and other websites and although I usually have good Google Fu, I did not find my answers.

Further, I will have to pay theh taxes, of course. How is that actually executed? Is it done via the 1040ES form or some other document? The 1040ES worksheet really does not work for a Roth conversion. Do I just estimate the tax burden and send in payment with the 4th Qtr 1040ES form? Will I get dinged for not submitting the previous 1st thru 3rd Qtrs? I'm a bit gun shy because I've been fined in earlier years (only a few dollars) for being a couple of days late on one qtr's payment.

I've searched here and other websites and although I usually have good Google Fu, I did not find my answers.