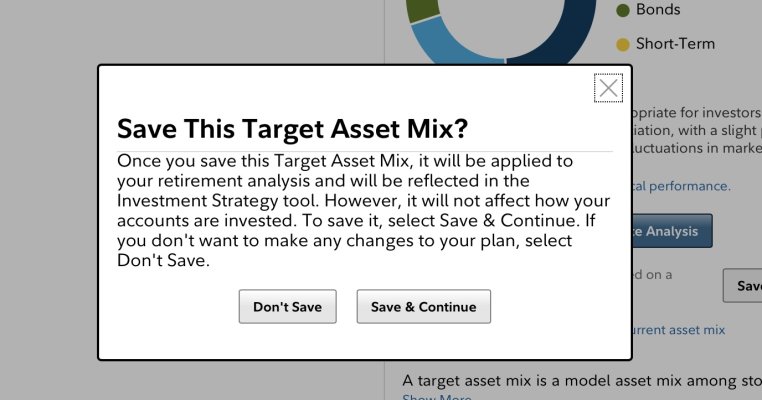

I learned something to share about Fidelity. Without warning, I found out the hard way that ANY info you enter into their planning tool to do modeling can and will impact the features on your accounts.

In my case, I was playing with their quite lame retirement planner which forces you to review their allocation and choice of ETFs based on your profile info.

I trade options, or more correctly, I use option trades to capture time risk premium on SPY selling or rolling covered calls. It is a conservative strategy which delivers a pretty consistent 6 to 14% annual return.

When I played with that planner, changing my risk to conservative, their system over night removed option trading on our accounts. Naively I called and asked them to correct it, but they could not. I was told I had to re-submit forms for each account to re-establish my aggressive risk profile needed to trade options.

Here I thought with mid 7 figures invested at Fido that our local rep would jump to fill out forms and get this corrected. Instead he left a message that there was nothing he could do. He even went so far as to suggest I contact my Schwab accounts manager who could take care of transfers back to them, where I still have option trading on our accounts.

I am considering his advice. However Fido does afford the ability to maintain cash in MM to cover trades that Schwab does not (not simply anyway). So I am forced to fill out paper to restore something that should not have occurred had their system provided some kind of warning.

Just in case others are playing with their retirement planner, beware....

In my case, I was playing with their quite lame retirement planner which forces you to review their allocation and choice of ETFs based on your profile info.

I trade options, or more correctly, I use option trades to capture time risk premium on SPY selling or rolling covered calls. It is a conservative strategy which delivers a pretty consistent 6 to 14% annual return.

When I played with that planner, changing my risk to conservative, their system over night removed option trading on our accounts. Naively I called and asked them to correct it, but they could not. I was told I had to re-submit forms for each account to re-establish my aggressive risk profile needed to trade options.

Here I thought with mid 7 figures invested at Fido that our local rep would jump to fill out forms and get this corrected. Instead he left a message that there was nothing he could do. He even went so far as to suggest I contact my Schwab accounts manager who could take care of transfers back to them, where I still have option trading on our accounts.

I am considering his advice. However Fido does afford the ability to maintain cash in MM to cover trades that Schwab does not (not simply anyway). So I am forced to fill out paper to restore something that should not have occurred had their system provided some kind of warning.

Just in case others are playing with their retirement planner, beware....