Huston55

Thinks s/he gets paid by the post

I’m typically disappointed by generic ‘one size fits all’ financial planning tools, and the first webpage of a recent “Fidelity Viewpoints” article on ‘How much do I need to retire?’ was no exception...I thought. It gives a Rule of Thumb: save 10x annual income by age 67 to retire successfully at that age. Great, thanks; not helpful at all!

However, after reading the details in the various links and a bit of using the tools, I have a more positive impression of them. Admittedly, the tools are somewhat basic & fit better for more normal age retirement (62-70 yo) but, the overall ‘Retirement Roadmap’ provides a well structured approach to key questions, with research based, easy to use tools to get one to the right place. For example:

- How much to save? (based on beginning age)

- How much will I need? (based on retirement age)

- What expenses will my savings cover?

- How much can I withdraw each year w/o running out of money?

For each of these questions, there are multiple interactive tools to help you analyze your own situation and/or multiple scenarios. Some key take always for me were:

- Their rule of thumb for how much to save is based on a 45% income replacement factor, with the remainder coming from SS (assumes no pension). This is lower than my goal was or than I’m comfortable with but, it’s probably applicable to a large percentage of retirees.

- Their model is based on steady income growth (1.5%/yr real). So, if your total compensation increased dramatically in the later portion of your career, this rule of thumb doesn’t work well.

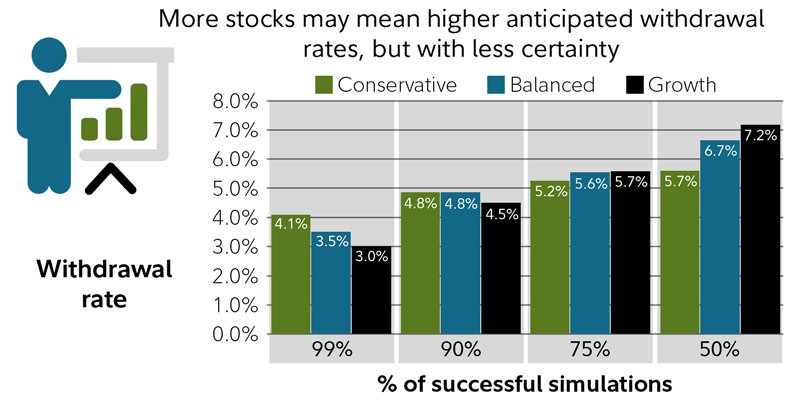

- If you’re in their recommended ranges & want a very high probability of portfolio survival, a more conservative AA (20-50% equities) is better than a more aggressive AA. (Note: this is based on Fido’s RIP tool, which I think is one of the best out there.)

- There are also some useful links to subjects like 401k rollover pros/cons, how to manage NUAs, etc.

- Their “See How You’re Doing” tool tells me we can spend a lot more than we currently do; with the most spending possible from a more conservative AA. (Guess I gotta call up RobbieB and get lessons on how to “Blow that Dough!”)

What do you think of Fidelity’s retirement planning tools? How do they compare to the tools on other brokerage sites?

https://www.fidelity.com/viewpoints/retirement/how-much-money-do-i-need-to-retire

ETA: I’m a big fan of Fido’s RIP tool but, this post & link are more about the other retirement planning tools available on the Fidelity website.

However, after reading the details in the various links and a bit of using the tools, I have a more positive impression of them. Admittedly, the tools are somewhat basic & fit better for more normal age retirement (62-70 yo) but, the overall ‘Retirement Roadmap’ provides a well structured approach to key questions, with research based, easy to use tools to get one to the right place. For example:

- How much to save? (based on beginning age)

- How much will I need? (based on retirement age)

- What expenses will my savings cover?

- How much can I withdraw each year w/o running out of money?

For each of these questions, there are multiple interactive tools to help you analyze your own situation and/or multiple scenarios. Some key take always for me were:

- Their rule of thumb for how much to save is based on a 45% income replacement factor, with the remainder coming from SS (assumes no pension). This is lower than my goal was or than I’m comfortable with but, it’s probably applicable to a large percentage of retirees.

- Their model is based on steady income growth (1.5%/yr real). So, if your total compensation increased dramatically in the later portion of your career, this rule of thumb doesn’t work well.

- If you’re in their recommended ranges & want a very high probability of portfolio survival, a more conservative AA (20-50% equities) is better than a more aggressive AA. (Note: this is based on Fido’s RIP tool, which I think is one of the best out there.)

- There are also some useful links to subjects like 401k rollover pros/cons, how to manage NUAs, etc.

- Their “See How You’re Doing” tool tells me we can spend a lot more than we currently do; with the most spending possible from a more conservative AA. (Guess I gotta call up RobbieB and get lessons on how to “Blow that Dough!”)

What do you think of Fidelity’s retirement planning tools? How do they compare to the tools on other brokerage sites?

https://www.fidelity.com/viewpoints/retirement/how-much-money-do-i-need-to-retire

ETA: I’m a big fan of Fido’s RIP tool but, this post & link are more about the other retirement planning tools available on the Fidelity website.

Last edited: