ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

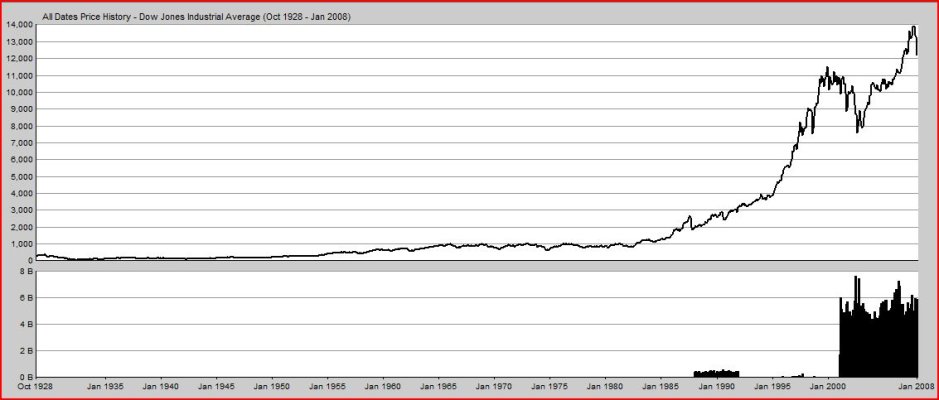

OK, Haha brought this up in 2005 ( http://www.early-retirement.org/forums/f28/worst-draw-down-15925.html ). The recent uncertainty in the markets may make this topic worth re-visiting.

Some people feel pretty comfortable with that '95% Success Rate' on the 30 year plan in FireCalc. I looked at the data in a slightly different way that I think is more tangible.

I used the FireCalc defaults (for convenience, I changed the 30,000/750,000 spend/portfolio numbers to 40,000/1,000,000 so the numbers convert to % with just a decimal shift).

If you think a 4% SWR and 95% is 'good enough', how would you feel if your original $1,000,000 buying power was just $274,000 in 15 years? You could be down 73% and you are only half way in to your 30 years! Could you be calm, and say 'Sure, I blew through almost 3/4 of my nest egg, but history says I should do OK.' BTW, that 95% success rate says that you will run out in year 24 in the worst case year.

Yes, that is the worst case history for the data set, but it happened. And if you look at all the squiggly lines on that chart, that sequence is not an outlier - it has plenty of company in the neighborhood. And the future could be worse.

So, drop your SWR to 3.5%? OK, you could be down 66% instead of 73%. Still pretty unsettling.

Does more weight to fixed income help? OK, go 50/50, and you would be down 70% at a 4% SWR; 64% with a 3.5% SWR.

A few runs and it seemed to show that if you want some assurance that the buying power of your net worth does not drop by more than half, you are looking at ~ a 2% SWR. At that point, time frame doesn't seem to matter much.

And I will also reiterate the point regarding life expectancy tables. Those are medians - if you want a 95% 'success' factor to apply to how long your portfolio needs to last, apply the Vanguard calculator until you get 5% chance of achieving X age for you or you and your spouse.

I was surprised by the results myself. I'm currently around 3.6% SWR, with pensions and SS yet to come, so I'm not shaking in my boots, but I know a 50% drop in NW would have me, ummm.... 'concerned'.

Thoughts?

-ERD50

PS - I will be out most of Sunday, so I won't have a chance to reply to any responses until later.

Some people feel pretty comfortable with that '95% Success Rate' on the 30 year plan in FireCalc. I looked at the data in a slightly different way that I think is more tangible.

I used the FireCalc defaults (for convenience, I changed the 30,000/750,000 spend/portfolio numbers to 40,000/1,000,000 so the numbers convert to % with just a decimal shift).

If you think a 4% SWR and 95% is 'good enough', how would you feel if your original $1,000,000 buying power was just $274,000 in 15 years? You could be down 73% and you are only half way in to your 30 years! Could you be calm, and say 'Sure, I blew through almost 3/4 of my nest egg, but history says I should do OK.' BTW, that 95% success rate says that you will run out in year 24 in the worst case year.

Yes, that is the worst case history for the data set, but it happened. And if you look at all the squiggly lines on that chart, that sequence is not an outlier - it has plenty of company in the neighborhood. And the future could be worse.

So, drop your SWR to 3.5%? OK, you could be down 66% instead of 73%. Still pretty unsettling.

Does more weight to fixed income help? OK, go 50/50, and you would be down 70% at a 4% SWR; 64% with a 3.5% SWR.

A few runs and it seemed to show that if you want some assurance that the buying power of your net worth does not drop by more than half, you are looking at ~ a 2% SWR. At that point, time frame doesn't seem to matter much.

And I will also reiterate the point regarding life expectancy tables. Those are medians - if you want a 95% 'success' factor to apply to how long your portfolio needs to last, apply the Vanguard calculator until you get 5% chance of achieving X age for you or you and your spouse.

I was surprised by the results myself. I'm currently around 3.6% SWR, with pensions and SS yet to come, so I'm not shaking in my boots, but I know a 50% drop in NW would have me, ummm.... 'concerned'.

Thoughts?

-ERD50

PS - I will be out most of Sunday, so I won't have a chance to reply to any responses until later.

(I'm sure you can hardly wait).

(I'm sure you can hardly wait).