|

|

07-17-2021, 05:37 AM

07-17-2021, 05:37 AM

|

#1

|

|

Confused about dryer sheets

Join Date: Jun 2021

Location: North East

Posts: 7

|

Firecalc vs reality

I discovered Firecalc a few weeks ago and have been obsessed with crunching numbers. I'm planning on retiring in 2 years at age 55. For those that have been retired for a while - I was wondering how your Firecalc results compare to real life. Thanks.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

07-17-2021, 05:52 AM

07-17-2021, 05:52 AM

|

#2

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,374

|

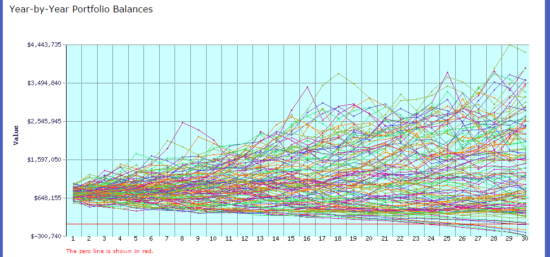

I'm pretty sure that my actual results for my first 10 years of retirement aligns very well with at least one of those squiggly lines.

I can give you a better answer in 20 years.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

07-17-2021, 06:33 AM

07-17-2021, 06:33 AM

|

#3

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2013

Posts: 1,884

|

Quote: Quote:

Originally Posted by ncbound

I discovered Firecalc a few weeks ago and have been obsessed with crunching numbers. I'm planning on retiring in 2 years at age 55. For those that have been retired for a while - I was wondering how your Firecalc results compare to real life. Thanks.

|

Not sure what you're asking...firecalc doesn't attempt to predict the future. It shows how your portfolio/income streams would have fared in the past.

|

|

|

07-17-2021, 07:59 AM

07-17-2021, 07:59 AM

|

#4

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2018

Location: Tampa

Posts: 11,299

|

Since it is rare that anyone actually withdraws 4% inflation adjusted yearly in a linear fashion, the results would not truly be apples to apples.

It is best used in a pre retirement am I ready scenario.

Others do use it in a retirement anew each year concept.

__________________

TGIM

|

|

|

07-17-2021, 08:06 AM

07-17-2021, 08:06 AM

|

#5

|

|

Full time employment: Posting here.

Join Date: Mar 2008

Posts: 968

|

Run your numbers in several calculators. Firecalc, i-opr.com, and also Fidelity has a good planner. Lots of variables, including your correct input and the market make a difference. That said, each of those calculators gave (and still give) me very similar results, which gave us high confidence on retirement by 55.

Nothing is a guarantee, but these tools will give you a current snapshot of the likelihood of success.

|

|

|

07-17-2021, 08:17 AM

07-17-2021, 08:17 AM

|

#7

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2014

Posts: 2,511

|

you are comparing apples to grapes.

you will have a single plot on how your assets vary over the rest of your life.

Firecalc will run many data sets and calculate likelihood that you will run out of money before you diel

|

|

|

07-17-2021, 08:31 AM

07-17-2021, 08:31 AM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,304

|

Quote: Quote:

Originally Posted by ncbound

I discovered Firecalc a few weeks ago and have been obsessed with crunching numbers. I'm planning on retiring in 2 years at age 55. For those that have been retired for a while - I was wondering how your Firecalc results compare to real life. Thanks.

|

As others have said, it doesn’t “compare to real life.” I’ll illustrate with pictures (that you’ve seen). Which line would you “compare to?” FIRECALC is an axe (vs a scalpel) to help users to develop a target portfolio amount to shoot for, not a retirement spending plan.

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

07-17-2021, 10:13 AM

07-17-2021, 10:13 AM

|

#9

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2011

Location: Reading, MA

Posts: 1,798

|

Focusing on the "reality" part of the OP's question, I would say that in my ninth year of retirement now, my personal plot would be one in the upper half of the preceding graph.

This is especially true in my case after starting age 70 SS last year...

|

|

|

07-17-2021, 10:45 AM

07-17-2021, 10:45 AM

|

#10

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2013

Posts: 11,078

|

After 8 years it's spot on one of those lines.

Best to control the things you can like asset allocation and maybe think about a cash buffer?

I remember when I was doing the same thing as you are. After 8 years I am more confident and relaxed. That is why I don't think you're going to find many people who saved a projection from the past to compare with today. Perhaps I'm underestimating the board.

|

|

|

07-17-2021, 11:23 AM

07-17-2021, 11:23 AM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2016

Posts: 8,968

|

Ok, real world numbers.

Retired 7 years ago and have been spending at 5 to 7% WR the whole time.

Investable assets up 50% and net worth up 45%. Blow That Dough!

|

|

|

07-17-2021, 11:30 AM

07-17-2021, 11:30 AM

|

#12

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2018

Location: Tampa

Posts: 11,299

|

Quote: Quote:

Originally Posted by MRG

After 8 years it's spot on one of those lines.

Best to control the things you can like asset allocation and maybe think about a cash buffer?

I remember when I was doing the same thing as you are. After 8 years I am more confident and relaxed. That is why I don't think you're going to find many people who saved a projection from the past to compare with today. Perhaps I'm underestimating the board.

|

I do run Firecalc at year end and save those results using effectively a retire again and again concept.

I love playing with numbers in general, so there is that.

__________________

TGIM

|

|

|

07-17-2021, 01:48 PM

07-17-2021, 01:48 PM

|

#13

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2007

Location: St. Louis

Posts: 1,563

|

Quote: Quote:

Originally Posted by bingybear

you are comparing apples to grapes.

you will have a single plot on how your assets vary over the rest of your life.

Firecalc will run many data sets and calculate likelihood that you will run out of money before you diel

|

True but starting with a bear is good to test a portfolio's toughness. Two bears in the first ten years that should be a good test.

|

|

|

07-17-2021, 01:53 PM

07-17-2021, 01:53 PM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2018

Location: Tampa

Posts: 11,299

|

Quote: Quote:

Originally Posted by FANOFJESUS

True but starting with a bear is good to test a portfolio's toughness. Two bears in the first ten years that should be a good test.

|

IIRC, the 2000 yr retiree is still surviving and is not in the top 5 of worst years to begin a retirement.

__________________

TGIM

|

|

|

07-17-2021, 01:58 PM

07-17-2021, 01:58 PM

|

#15

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2005

Location: Chicago

Posts: 13,186

|

Quote: Quote:

Originally Posted by FANOFJESUS

True but starting with a bear is good to test a portfolio's toughness. Two bears in the first ten years that should be a good test.

|

If you really want to test "toughness" start at the beginning of a period of high inflation.

__________________

"I wasn't born blue blood. I was born blue-collar." John Wort Hannam

|

|

|

07-17-2021, 02:08 PM

07-17-2021, 02:08 PM

|

#16

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2011

Location: Reading, MA

Posts: 1,798

|

Quote: Quote:

Originally Posted by youbet

If you really want to test "toughness" start at the beginning of a period of high inflation.

|

Interesting that you mention that.

The economy is JUST getting heated up for that...

|

|

|

07-17-2021, 02:27 PM

07-17-2021, 02:27 PM

|

#17

|

|

Full time employment: Posting here.

Join Date: Jul 2013

Location: London/UK (dual US/UK citizen)

Posts: 502

|

I was blessed to start FIRE in 2012. The market has gained far more than I’ve wanted to spend so “sequence of returns” has been my friend. I’m better off now than i was. If the next 10 years instead are low/no gains high inflation, and you retire today, follow a 1966 scenario to see how you’ll do. It is all about how the markets treat you particularly in the first few years of Fire. Stay alert, flexible, and don’t spend crazily until you have a better feel for how your base years are playing out.

|

|

|

07-17-2021, 03:56 PM

07-17-2021, 03:56 PM

|

#18

|

|

Full time employment: Posting here.

Join Date: Jan 2014

Location: Austin

Posts: 661

|

Quote: Quote:

Originally Posted by RobbieB

Ok, real world numbers.

Retired 7 years ago and have been spending at 5 to 7% WR the whole time.

Investable assets up 50% and net worth up 45%. Blow That Dough!

|

Same here. 7 years later up 45% from what I started with even after spending more than double what I had thought I would. I know that can't last forever but it's comforting to know I've successfully navigated thru those critical early years of RE.

__________________

ER'd 6/1/2014 @ age 53. Wow, is it already 2022?

|

|

|

07-17-2021, 04:18 PM

07-17-2021, 04:18 PM

|

#19

|

|

Confused about dryer sheets

Join Date: Jun 2021

Location: North East

Posts: 7

|

Thanks

Thanks for all the replies. The more I look at our numbers and read this forum the more confident and excited we get about retiring early.

|

|

|

07-17-2021, 04:22 PM

07-17-2021, 04:22 PM

|

#20

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2014

Location: Apex and Bradenton

Posts: 1,848

|

Where in NC are you bound for?

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|