REWahoo

Give me a museum and I'll fill it. (Picasso) Give

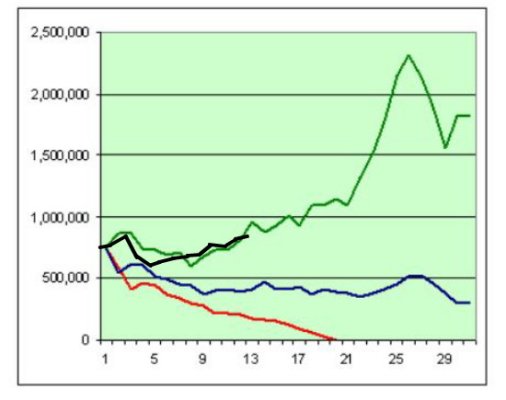

The graph in post #91 shows how my portfolio has performed (relative to the three FIRECalc examples) since 2005. The 2015 portion of the line has a slightly downward slope.Isn't it actually that your portfolio shrank in 2015? It dropped due to your withdrawal at the beginning, then probably went down some due to market drops.