explanade

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 10, 2008

- Messages

- 7,441

I'm coming up on 7 years since FIRE.

My spending rate has been flat. I'm not talking flat percentage, but flat sum.

Meanwhile the value of assets are up over 80%, not even adding up the money I've withdrawn.

Or more accurately, I've mostly lived off dividends and the savings I had 7 years ago. I've not sold shares other than some minor numbers for tax loss harvesting.

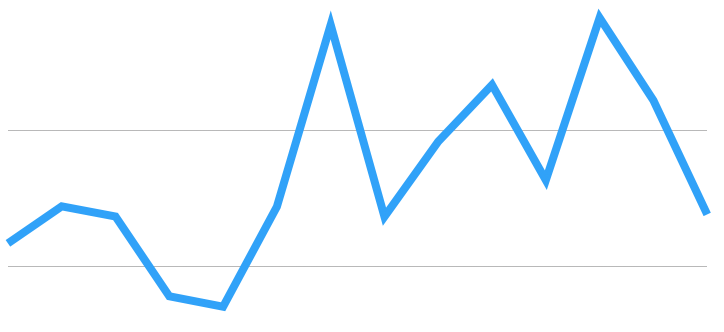

So in the first year, my spending represented maybe 2% of total assets.

In 2020, with reduced spending from the pandemic, spending is less than 1% of asset value at the end of 2020 (market was down a lot around April and May and had gone up a lot by the end of the year).

In 2019, which was my highest spending year since RE (and also the highest spending year ever), it was 1.7% of total asset value at end of 2019.

So at about half way point in 2021, I would be on pace to spend less than 1.2% of my current assets, as of Friday.

In dollar terms, I've been at the same level, give or take maybe $10-15k?

It's not that I'm necessarily trying to LBMY. The first few years were tentative, uncertainty about living only on retirement assets, uncertainly about the market direction, which had already risen a lot in the 5-10 years before I FIRE'd, even accounting for the 2008 Financial Crisis.

But do I need to pick a higher withdrawal rate and stick to it no matter what?

A lot of folks seem to rebalance at the start of the year so they're selling their SWR calculated against their ending asset value at the end of the previous year?

I'm 60 so there would be SS to add to the spending in a couple of years and RMDs in no more than 10 years.

My spending rate has been flat. I'm not talking flat percentage, but flat sum.

Meanwhile the value of assets are up over 80%, not even adding up the money I've withdrawn.

Or more accurately, I've mostly lived off dividends and the savings I had 7 years ago. I've not sold shares other than some minor numbers for tax loss harvesting.

So in the first year, my spending represented maybe 2% of total assets.

In 2020, with reduced spending from the pandemic, spending is less than 1% of asset value at the end of 2020 (market was down a lot around April and May and had gone up a lot by the end of the year).

In 2019, which was my highest spending year since RE (and also the highest spending year ever), it was 1.7% of total asset value at end of 2019.

So at about half way point in 2021, I would be on pace to spend less than 1.2% of my current assets, as of Friday.

In dollar terms, I've been at the same level, give or take maybe $10-15k?

It's not that I'm necessarily trying to LBMY. The first few years were tentative, uncertainty about living only on retirement assets, uncertainly about the market direction, which had already risen a lot in the 5-10 years before I FIRE'd, even accounting for the 2008 Financial Crisis.

But do I need to pick a higher withdrawal rate and stick to it no matter what?

A lot of folks seem to rebalance at the start of the year so they're selling their SWR calculated against their ending asset value at the end of the previous year?

I'm 60 so there would be SS to add to the spending in a couple of years and RMDs in no more than 10 years.