Bruceski44

Recycles dryer sheets

- Joined

- Apr 13, 2016

- Messages

- 191

I just checked these out here. The bonds have two rate determiners:

1. The fixed rate (currently 0.00%) for the life of the bond.

2. The CPI-U inflation rate determined on May 1 and Nov 1 (currently 3.56%)

The composite rate is shown, but when the fixed rate is 0.00% (as it will be for the life of any bonds bought now) it works out to 2x the inflation rate, or 7.12%.

The pros are well-known, primarily being risk-free.

There are a few cons which prevent me from filling my basket:

1. The inflation rate underestimates true inflation, even though it includes gasoline and food costs.

2. The inflation rate is readjusted every 6 months.

3. The interest is compounded every 6 months.

4. The bonds are good for 30 years, but if you sell before 5 years has elapsed, you lose 3 months interest.

5. The bonds must be held at least one year.

6. Once inflation returns to "normal" levels, you will be holding an investment earning near-zero interest again.

7. With a 0.00% fixed rate, you miss out on an additional kicker calculation for the rate earned - for the life of the bond.

8. You are generally limited to buying $10,000 per year per person.

My conclusions:

1. If buying now, you may get a year or more of >7% rates, compounded semi-annually. After that, composite rates will drop, possibly to 3%-5% range. Not compelling.

2. They are somewhat liquid, but with a penalty of one-half of one compounding period if sold before 5 years.

3. The real inflation rate is being underestimated, especially essential fixed costs like home heating, car fuels and food.

4. Due to the limited purchase quantities allowed and underestimated inflation, these do not represent an effective inflation hedge to me.

5. If inflation persists, and interest rates go up (both pretty unlikely with all the financial engineering we're seeing), these bonds may be a good hedge, as long as the fixed rate is >0% when purchased.

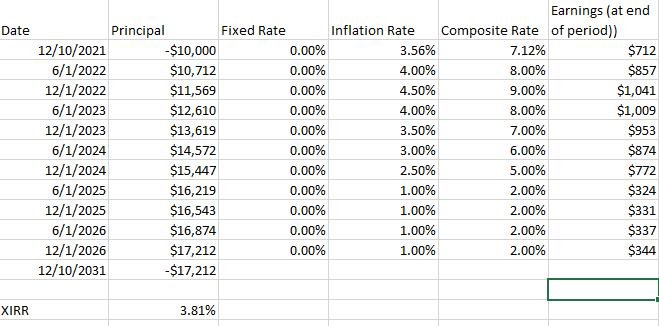

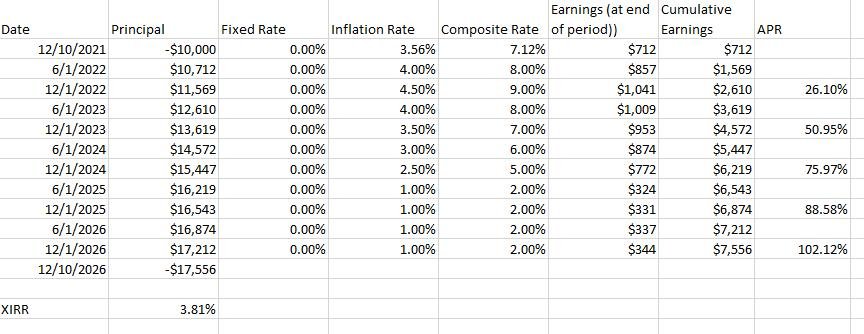

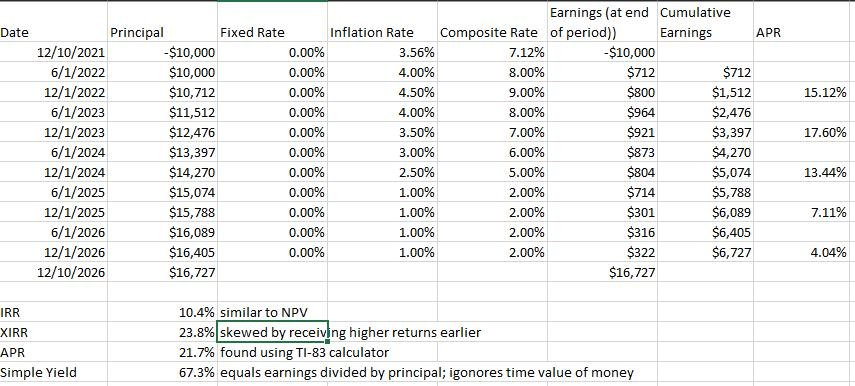

Earnings example in attached image. 3.81% XIRR after 5 years if inflation returns to normal within 3.5 years. Note: Normal inflation is <1% per the page linked above. Meh.

1. The fixed rate (currently 0.00%) for the life of the bond.

2. The CPI-U inflation rate determined on May 1 and Nov 1 (currently 3.56%)

The composite rate is shown, but when the fixed rate is 0.00% (as it will be for the life of any bonds bought now) it works out to 2x the inflation rate, or 7.12%.

The pros are well-known, primarily being risk-free.

There are a few cons which prevent me from filling my basket:

1. The inflation rate underestimates true inflation, even though it includes gasoline and food costs.

2. The inflation rate is readjusted every 6 months.

3. The interest is compounded every 6 months.

4. The bonds are good for 30 years, but if you sell before 5 years has elapsed, you lose 3 months interest.

5. The bonds must be held at least one year.

6. Once inflation returns to "normal" levels, you will be holding an investment earning near-zero interest again.

7. With a 0.00% fixed rate, you miss out on an additional kicker calculation for the rate earned - for the life of the bond.

8. You are generally limited to buying $10,000 per year per person.

My conclusions:

1. If buying now, you may get a year or more of >7% rates, compounded semi-annually. After that, composite rates will drop, possibly to 3%-5% range. Not compelling.

2. They are somewhat liquid, but with a penalty of one-half of one compounding period if sold before 5 years.

3. The real inflation rate is being underestimated, especially essential fixed costs like home heating, car fuels and food.

4. Due to the limited purchase quantities allowed and underestimated inflation, these do not represent an effective inflation hedge to me.

5. If inflation persists, and interest rates go up (both pretty unlikely with all the financial engineering we're seeing), these bonds may be a good hedge, as long as the fixed rate is >0% when purchased.

Earnings example in attached image. 3.81% XIRR after 5 years if inflation returns to normal within 3.5 years. Note: Normal inflation is <1% per the page linked above. Meh.