|

|

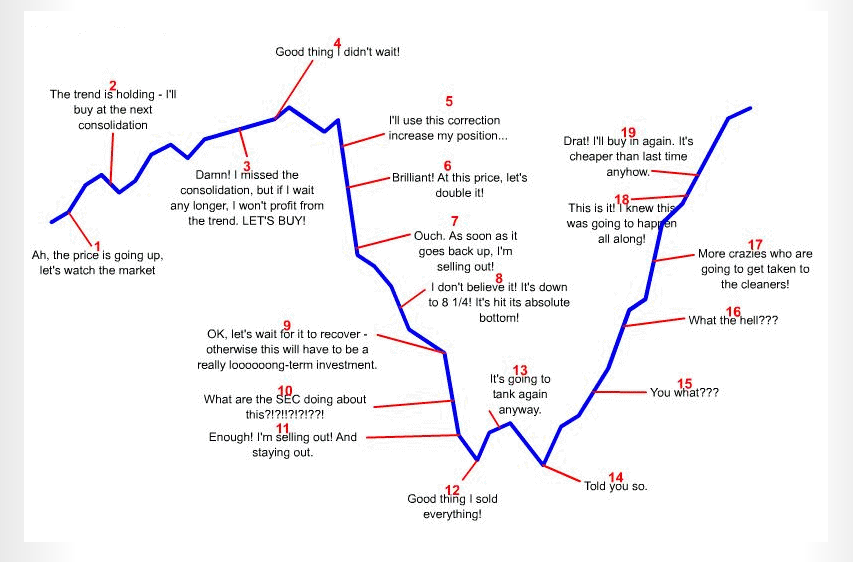

funny investor sentiment graph

08-14-2008, 04:59 AM

08-14-2008, 04:59 AM

|

#1

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2005

Posts: 2,713

|

funny investor sentiment graph

found by way of:

naked capitalism

I don't think anyone who is honest with themselves has completely avoided having any of these reactions..

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

08-14-2008, 08:11 AM

08-14-2008, 08:11 AM

|

#2

|

|

Recycles dryer sheets

Join Date: Aug 2006

Posts: 478

|

Too true. We're our own worst enemy.

That's why I haven't bought any individual securities in about 8-10 yrs, and am thinking about selling the few I have left.

This graph should be required to be printed on every brokerage application form.

__________________

I still don't get it...

|

|

|

08-14-2008, 09:00 AM

08-14-2008, 09:00 AM

|

#3

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2006

Posts: 1,183

|

Thanks a bunch! After the past 2 months this explains so much!!! I already sent it to my one friend who can discuss the market with me. All my other friends prefer to work to pay an advisor like a bunch of lemmings, or are so far upside down in debt they wish we still had poorhouses.

|

|

|

08-14-2008, 09:06 AM

08-14-2008, 09:06 AM

|

#4

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2005

Posts: 2,713

|

hey, what happened to the graphic? It disappeared.

Boh.

Here is the linked link (to a link  ): Slope of Hope with Tim Knight

and a copy I nabbed:

(the original is back now.. oh well, at least it is now uploaded for posterity)

|

|

|

08-14-2008, 09:53 AM

08-14-2008, 09:53 AM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

Perfect illustration of how the twin emotional mistakes of fear and greed wreck portfolios.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

08-14-2008, 12:34 PM

08-14-2008, 12:34 PM

|

#6

|

|

Moderator Emeritus

Join Date: Dec 2005

Posts: 10,125

|

Well, I am depressed about the market so I am buying. We shall see if I am right or wrong.

__________________

Angels danced on the day that you were born.

|

|

|

08-14-2008, 12:51 PM

08-14-2008, 12:51 PM

|

#7

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2006

Posts: 1,183

|

I'm enthused about the market! Almost out of the weeds from the last 2 months. Life is good!

|

|

|

08-14-2008, 01:10 PM

08-14-2008, 01:10 PM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Very funny, and something I can personally relate to.

But, but, but, at this point in time, do you think we are at point #10 in the above graph, or at point #15?

Please help me, as I have no clue ... Maybe even point #6?

|

|

|

08-14-2008, 03:14 PM

08-14-2008, 03:14 PM

|

#9

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2005

Posts: 2,713

|

personally? probably at #7

|

|

|

08-14-2008, 04:06 PM

08-14-2008, 04:06 PM

|

#10

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2006

Location: Boise

Posts: 7,882

|

Quote: Quote:

Originally Posted by NW-Bound

Very funny, and something I can personally relate to.

But, but, but, at this point in time, do you think we are at point #10 in the above graph, or at point #15?

Please help me, as I have no clue ... Maybe even point #6?  |

Between #14 and #15, if you ask me.

But my experience differs from around #14 on. What I've seen is that after about #14, news writers become disgusted or bored with the stock market and move on to another topic, like global warming, the Olympics, or the Russian invasion of Georgia, or whatever. The subsequent rise in the market is ignored until it sets new highs, then the cycle repeats with the journalists renewing their interest around #3.

2Cor521

__________________

"At times the world can seem an unfriendly and sinister place, but believe us when we say there is much more good in it than bad. All you have to do is look hard enough, and what might seem to be a series of unfortunate events, may in fact be the first steps of a journey." Violet Baudelaire.

|

|

|

08-14-2008, 04:14 PM

08-14-2008, 04:14 PM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

I am obviously somewhere between ladelfina and 2Cor521.

Let's make it into a poll. This is going to be fun!

|

|

|

08-14-2008, 04:30 PM

08-14-2008, 04:30 PM

|

#12

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

My guess, and it is only that, is that we are experiencing a bear market rally likely of relatively short duration, and we will eventually see new lows. This October could be cute!

But the snapback has been fun. Right or wrong, I have already cashed some gains in IRA.

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

08-14-2008, 04:34 PM

08-14-2008, 04:34 PM

|

#13

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Ha meant we are at point 13. Which means in the long run, it's not a bad time to buy.

I have been buying slowly the last 2 weeks. But then, I was working from a 52% cash position. So far, so good. Down to 48% cash.

P.S. I should add that for the last 2 weeks, my total has been pretty much constant, i.e. does not fluctuate nearly as much as the indices. What happened was that my various stocks moved opposite each other (energy+material vs. most other stocks), and canceled each other out. Is that good or bad?

Hopefully, when the market recovers, they will all participate and stop their tug-of-war! I have been buying some tech stocks.

|

|

|

08-14-2008, 04:54 PM

08-14-2008, 04:54 PM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Quote: Quote:

Originally Posted by NW-Bound

Ha meant we are at point 13. Which means in the long run, it's not a bad time to buy.

|

NW, you may indeed be correct that we are at point 13, but that is not what I meant. I think the graph is cute and psychologically descriptive, but if I thought that we were at point 13 I would consider that "the bottom".

I do think that there are a lot of moderate values, but I also think that I at least need to see more blood. When I am scared sh*tless and thinking "why in hell didn't I just sell everything summer 2008?" -that is when I will try to buy for a good long time.

A poor earnings pre-announcement season this fall, or worse news on employment and production could get us there.

This may not even happen, but I will still be OK there too- not optimal but OK.

A person who is definitely not going back (or can't go back) to work needs to be careful.

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

08-14-2008, 05:03 PM

08-14-2008, 05:03 PM

|

#15

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Even if I want to buy, do I have any money left to buy?

One who has retired must think differently than one who is young and still accumulating. It slowly dawned on me that I have left the latter group, and joined the former.

When you have no new money to invest, it limits your choice, even if you have become arguably "wiser" with age.

|

|

|

08-14-2008, 05:24 PM

08-14-2008, 05:24 PM

|

#16

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,724

|

Of course, it doesn't have to bottom at point 13 and top at 19. This could be a cutout of a much bigger graph. Just look at the S&P in '01 and '02. Hit bottom and then rose 20% - twice. Then it really went down. I remember that well and am still sore.

Not sure what point we're on the graph, but it sure feels more like '01 than '03 to me. Time to be cautious.

|

|

|

08-14-2008, 05:31 PM

08-14-2008, 05:31 PM

|

#17

|

|

Recycles dryer sheets

Join Date: Jun 2008

Posts: 121

|

Personally, I think we're somewhere around #13 and we'll bounce around there for a while before the next and final leg down. I have been increasing my position in a few securities...cautiously.

|

|

|

08-14-2008, 05:35 PM

08-14-2008, 05:35 PM

|

#18

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2007

Posts: 4,764

|

14 its going to the moon.

(this is not investment advice)

|

|

|

08-14-2008, 05:49 PM

08-14-2008, 05:49 PM

|

#19

|

|

Recycles dryer sheets

Join Date: Feb 2008

Posts: 147

|

Wonderful graph, teaches a lot, thanks. My bet is on #13. Seems like a lot of potential bad news hasn't come to fruition yet. But I'm trying not to let that affect my investing. Since I'm still working I can afford to keep buying and rebalancing into equities, as I have been since January.

|

|

|

08-14-2008, 11:47 PM

08-14-2008, 11:47 PM

|

#20

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2006

Posts: 12,880

|

That graph explains why the average equity or mutual fund investor makes around 1.5% (IIRC -- that figure from Brennan's Straight Talk book).

__________________

Al

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|