nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

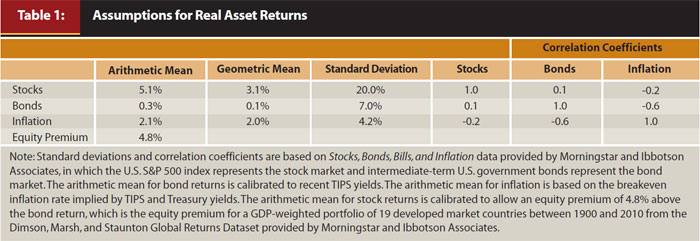

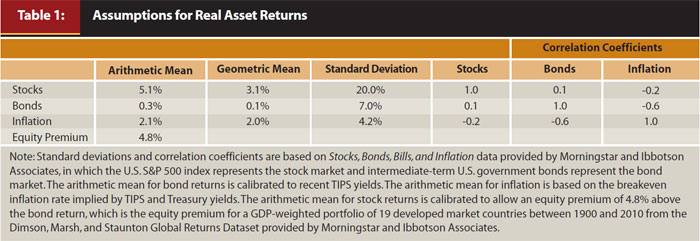

One of the critical inputs to any retirement income calculation is the size and distribution of investment returns. Some models use historical averages and standard deviations, but recently Pfau has used current intermediate US Government bond rates and then taken the premium in return from stocks that you would expect from the historical data and also uses that data to derive a distribution in returns. The paper is here and the critical numbers are given in Table 1.

https://www.onefpa.org/journal/Page...Efficient Frontier for Retirement Income.aspx

This obviously predicts lower than historical average returns. Is this the best way to estimate future returns?

https://www.onefpa.org/journal/Page...Efficient Frontier for Retirement Income.aspx

This obviously predicts lower than historical average returns. Is this the best way to estimate future returns?

Last edited: