HealthyFuture

Recycles dryer sheets

- Joined

- May 12, 2021

- Messages

- 101

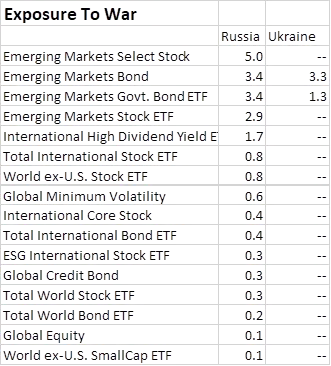

Asked the rep for retirement account company if it’s possible to divest from Russian holdings. She’s looking into it. Anyone else doing this? I’d appreciate learning what others may have learned about targeted divestments historically, too. I can’t sleep at night with the thought that I could be supporting Russia’s actions.