I'm not smart enough to explain the "hedge" statement in a step by step discussion. In effect, the overall hope to retain value is based on holding gold. Not gold mine stocks, and not "paper gold"... but the metal itself.

So many different things get into this... just to mention a few:

The paper gold may be as much as 16 times the actual amount of bullion in trade on a given day.

The FED is the eventual arbiter of the price, and that means the member banks.

Gold is traded mostly on the European exchange.

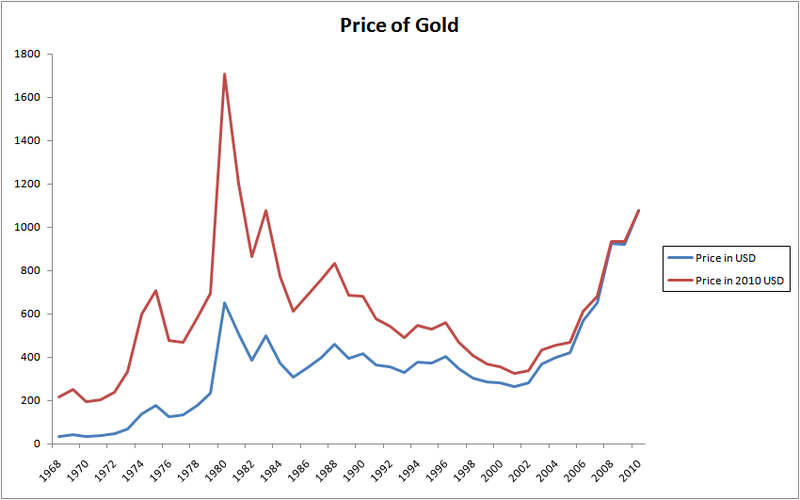

The price of gold is directly related to the amount of physical gold in circulation.

Those who control the physical gold can drive the prices up by simply not offering their metal in trade.

The eventual price of paper gold, is directly related to the perceived stability of the entity guaranteeing the eventual payment. (This is where some volatility comes in, as gold derivatives are involved in the trades.)

Now, as to the relationship of gold relative to the stability of the dollar, and its' relationship to the international market. It is a term based perception, which is usually, but not always balanced in the value of the US Dollar ie. US dollar vs. Japanese yen. The amount you see in the daily trading is just that. The daily trades. Beyond that, of course are many variables that the market may guess at, but does not know...

Since the top three GDP countries are the The US, Japan and China, they obviously will have the most influence. What the governments of the international monetary system do to keep confidence, also goes directly to the safety of the guarantees in the bank. Thus, if a bank is perceived to be unstable, the pay off on the gold will not be based on physical gold, and could result in losses to the stakeholders.

Now, as I see it, the growing perception is that the US is basically stronger vis a vis the long term recovery. The two major reasons that are becoming more important, looking to the future, are:

The underlying stability and build out of the infrastructure... roads, bridges, buildings, food supply, etc. ,

and...

The potential of the US to become energy independent within the next 20 to 25 years via the newer natural gas extraction processes. Again.. we are ahead in the technology, but more important we have the infrastructure to transport the fuel... which will difficult for other producing countries like China or Russia, to build out.

Of course, the endgame in this would come in an international imbalance in the monetary system. As countries lose credibility, and the banks destabilize, the losses would become real, then the return to holders of paper gold would be a percentage of the stated value.

At the same time, holders of the metal would take it off the market, enhancing the value of gold.

...................................................................................

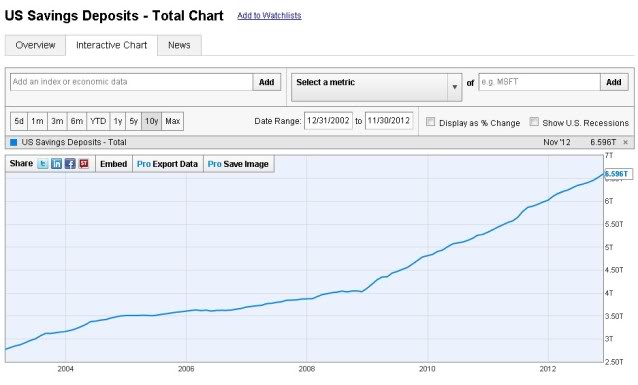

Yes, I realize this is not a matter for the investor to be concerned with... and yes a lot of assumptions, but with the total international debt at incredible levels.... US current debt 16T, world debt at more than $100T, and a look ahead 20 years total of 100T in the US alone... The thought that the world economy will "grow" out of this debt is pollyanna-ish.

And thus the original post.

My opinion only... just an excursion into "what if's". All of the points made by other members in the thread are well founded. I could not argue them away... It's just the way I've put the pieces together... time will tell! In the meantime, I surely won't be putting my money where my mouth is.

Maybe I need to convert that to tea bags or hog bellies to feel better.

Maybe I need to convert that to tea bags or hog bellies to feel better.