Question from a very unsophisticated potential investor.

Am 100% risk averse, but have been getting some "feelings" from friends, and a few goldbug websites that owning physical gold may be a good hedge right now.

Would like to hear some thoughts from those who know about these things. Mainly, safety... thinking four or five years out.

I am adamantly against buying gold as an investment. If you want to buy some coins because you are a collector or you want to buy gold jewelry because you like it, then have at it, but as an investment, for ME, it is WAAAAAAY too risky.

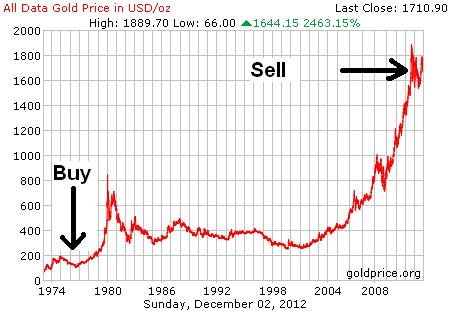

Historically gold has been a horrible investment. When gold prices spiked in 1980, it took 27 YEARS for it to get back there. Gold has had a nice run up the last 10 years, but that's an anomaly. The other thing about gold is that you get no dividends from gold. Gold has had a bit of a stall lately, and actually stocks have done better since 2009 than gold has (and many stocks pay dividends too).

Yes some people have done well with gold recently, but that does not mean it isn't wrought with risk. There is no precious metal, stock or commodity that is like gold which puts gold on an island. SOME people buy it as a hedge yes, but you also have a lot of crazy people out there who buy it because they think it will have value if the economy collapses. if things get so bad that we're bartering, stuff like water and batteries and toilet paper will have value. Gold is not guaranteed to hold any level of value.

Do what you will, but here are my reasons for not buying it:

1) Historically a bad investment.

2) At about its highest price ever, why choose NOW to buy?

3) No dividends.

4) VERY risky (and you say you're risk averse)...and let's be clear, it is speculation pure and simple.

You can do MUCH better for yourself over the long term by being diversified in good growth stock mutual funds. I prefer the division Dave Ramsey uses which is 25% each into the following types of funds - growth, aggressive growth, growth and income, and international. You have diversification there which includes the more conservative types (income). Ramsey says never buy bonds, but I disagree with him there. At age 46, I have 13% bonds and will likely up that to 30% when I retire.

Some will argue that adding precious metals just adds to your diversification, and while that's true, for ME, it's too risky of a sector.