I thought I had it finally figured out, but this article now confused me. Before quoting from the article, here's my understanding:

If you open the account and make the first contribution in 2019 and then convert in each subsequent tax year up through the present, even being older than 59 1/2 you can't withdraw the conversions without tax or penalty until January 1, 2024 (after the end of 5 tax years).

The article has the following (with a conversion instead of a contribution for the 2019 tax year):

"Age 65

Converted $20,000 in 2022, 2021, 2020, and 2019 for a total conversion basis of $100,000

Has $10,000 of earnings in 2023

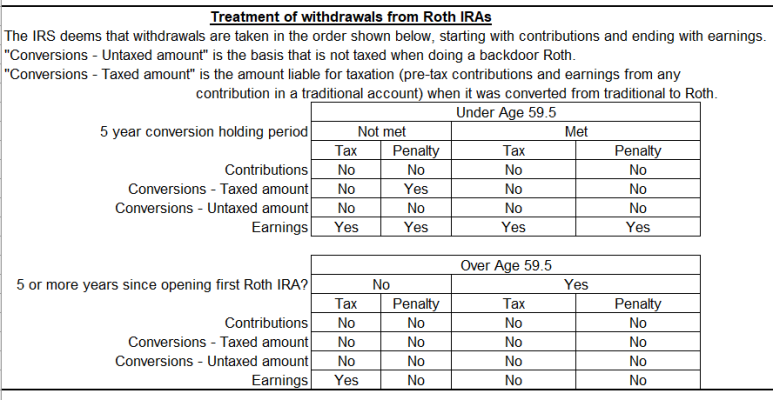

If the first conversion in 2019 was your first ever Roth contribution, then that would mean that your Roth IRA is not yet at least five years old. This would mean if you withdrew your entire conversion basis of $100,000, it would be free of tax because withdrawals from basis are always free of tax and free of penalty because you meet an exception to the early distribution penalty. The exception you meet is that you are older than age 59 1/2." (Emphasis added)

Many articles I've read say that the 5-year period applies to each individual conversion -- have I misread the linked article or is it wrong?