Red Badger

Thinks s/he gets paid by the post

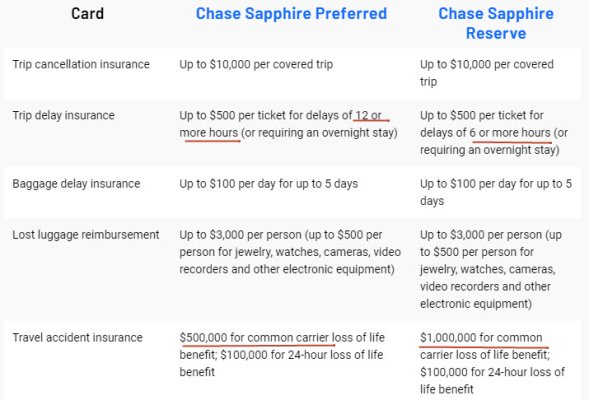

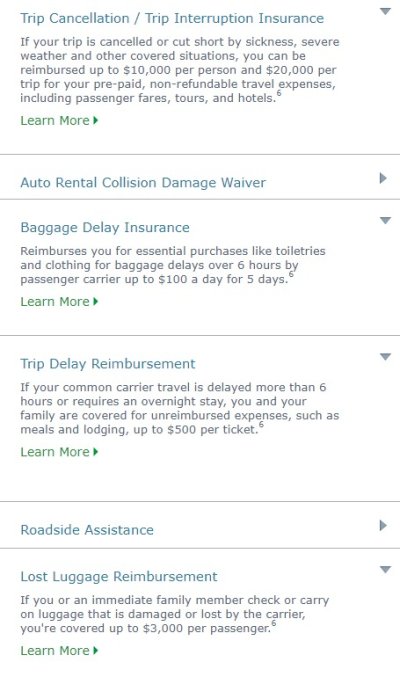

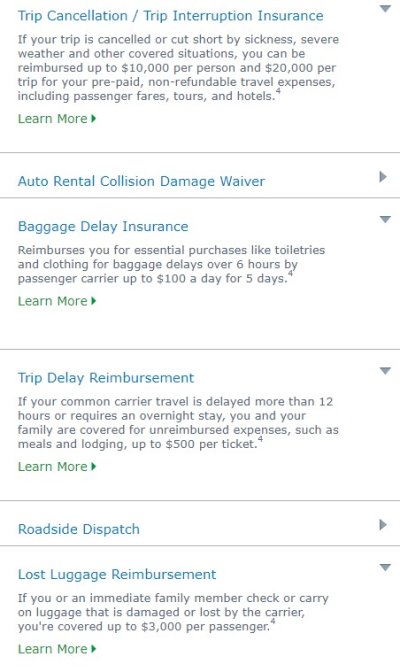

Saw an email from Chase with the title about some new bennies. Well, the real "benny" was a $100 increase in the annual fee (Going to $550). There were some convoluted programs for Lyft and Door Dash that I'll need to examine, but CSR is getting rather spendy. I really like all the perks that come with CSR, but,,,, I'll have to decide if they've priced themselves out of my market. YMMV!