Earl E Retyre

Full time employment: Posting here.

- Joined

- Jan 1, 2010

- Messages

- 541

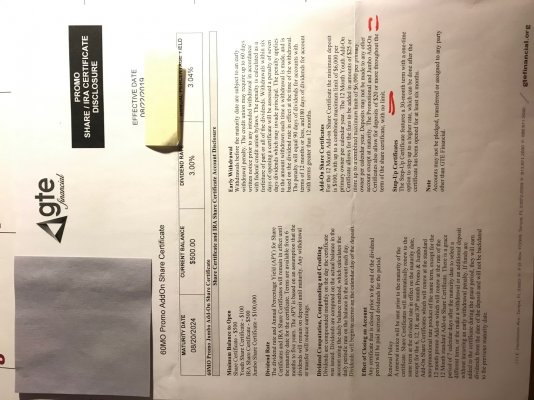

Several weeks ago I opened one of the GTE add-on 5 year 3.04% CD thanks to someone posting on this forum. I deposited $500 with the understanding that at any time I could add more funds at the rate of 3.04% over the term of the CD.

Today, I received an email indicating that GTE financial has changed the terms such that a maximum of $6,000 can be deposited per year. While I never understood how they could offer the original deal, I only opened the account due to the fact that I could add on and wanted to lock in the rate.

According to the email, GTE says, "This is in accordance with our right to amend terms of our promotional certificates stated on our website during the promotional period."

Is this legal? Did others know about this fine print?

Also, the email was received today (10/2) and said the terms go into affect (9/29) so there is no opportunity to add on more than $6,000.

Today, I received an email indicating that GTE financial has changed the terms such that a maximum of $6,000 can be deposited per year. While I never understood how they could offer the original deal, I only opened the account due to the fact that I could add on and wanted to lock in the rate.

According to the email, GTE says, "This is in accordance with our right to amend terms of our promotional certificates stated on our website during the promotional period."

Is this legal? Did others know about this fine print?

Also, the email was received today (10/2) and said the terms go into affect (9/29) so there is no opportunity to add on more than $6,000.