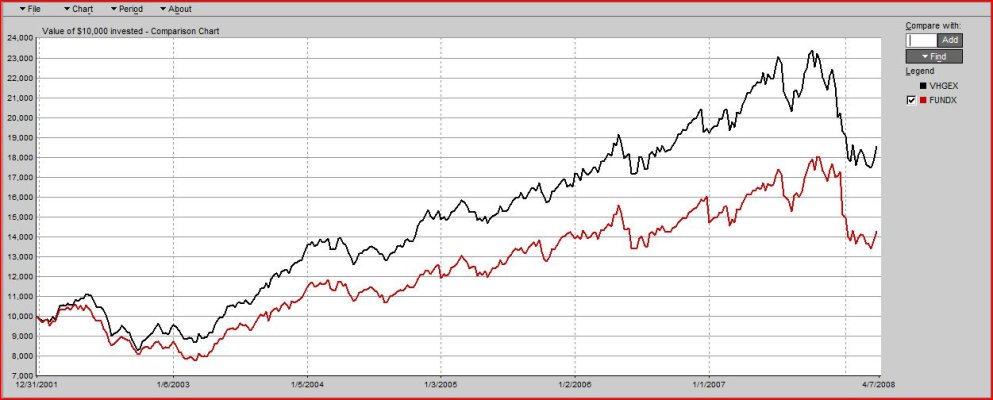

I already pointed to the vanguard REIT fund and their Global Equity fund, both of which beat fundx since its inception.

I also provided a link to a book report I wrote compiling the key points of hundreds of pages of materials that analyzed the jumpin' bejeezus out of this topic and came to the inescapable conclusion that active management and trying to time the market does not, has not, and will not produce significant improvements in returns. In fact, the overwhelming heap o' data says that active management and market timing reduces returns, increases costs, increases taxes, and produces a lot of disappointment.

So yes my mind is made up. I used to feel certain that some element of timing was very possible. I used to feel that active management simply MUST help at least a little bit when the markets are highly volatile. On the basis of having read big heaping piles of material that conclusively proved all of those suspicions to be blatantly false, I changed my mind.

There really ARE two kinds of people. Those that know they cant beat the market and those who dont know they cant beat the market.

Hey Twaddle you seem persistently interested in the benefits of momentum investing. Which newsletters are you subscribed to, which funds have you purchased and what % of your net worth is invested using this strategy?

I'm sure your money is where your mouth is.